A reader asks:

I’d love to see your take on a concrete savings/net worth amount targets by age for a comfortable life, without the hand-wavey “X% of your income” that so many other sites give. Income always changes so much from year to year so that response never feels worthwhile to me.

The percentage of income approach to how much money you should have saved is quite prevalent these days.

Something like this one from Bank of America:

I understand why some people might not be comfortable using this type of data as a benchmark.

Incomes do change from year to year. Some people work on a variable income as opposed to a salary. Plus, your absolute income level is context-dependent.

Making $250k a year in Iowa is drastically different than making $250k a year in NYC.

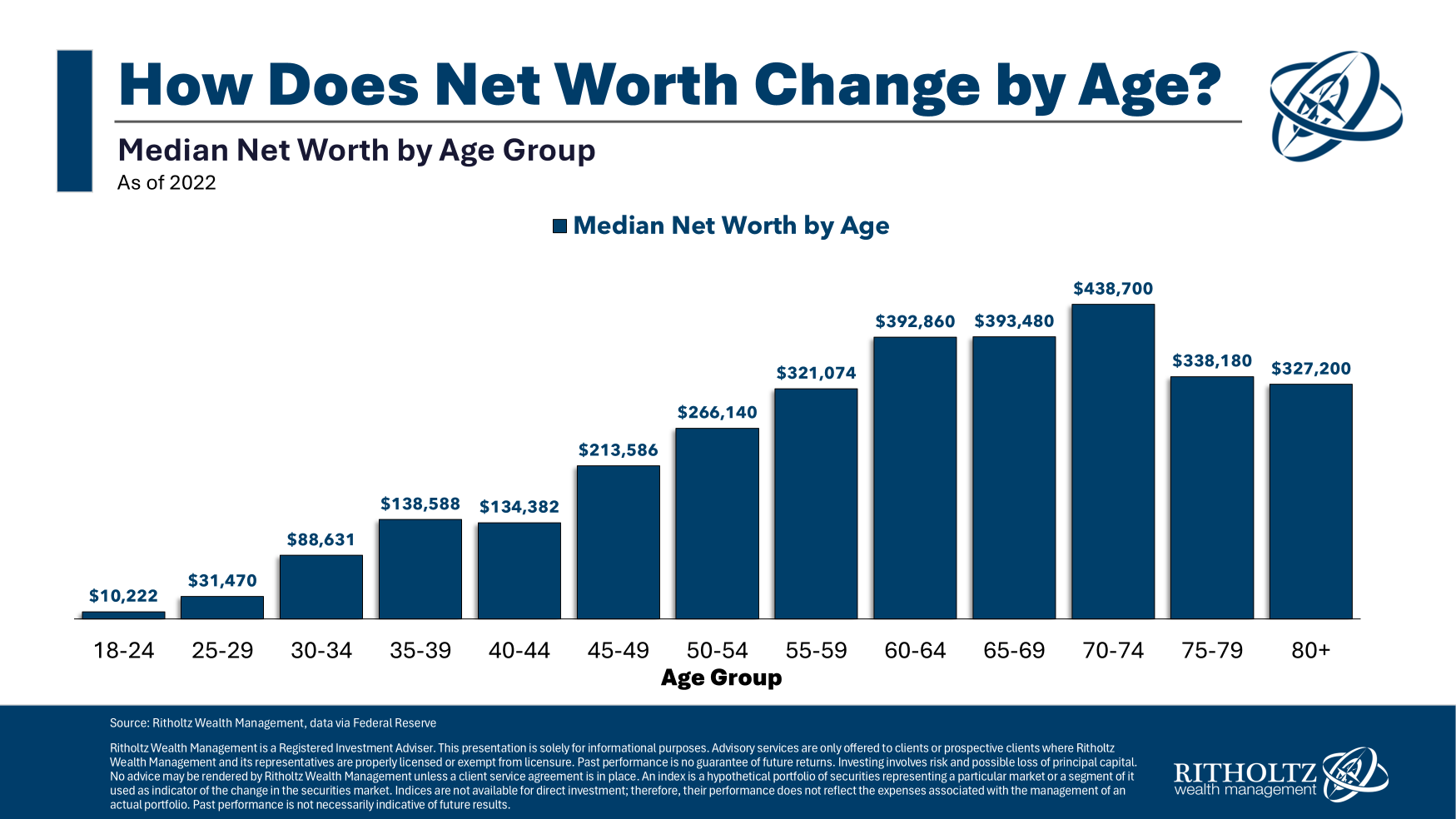

You could also benchmark by the actual numbers. Here’s a look at median net worth levels by various age groups:

These are the median net worth figures from the latest Federal Reserve Household Survey. They break them out by 5 year intervals. The problem here is that there is a wide range around the median figures.

For example, in the 40-44 age group, the median net worth is $134k. For the bottom 25%, it’s $23k. For the top 25% it’s $436k.

And for the top 10% and 1%, it’s $1.1 million and $7.8 million, respectively.

Something for everyone depending on who you would like to compare yourself with.

Unfortunately, there really is no satisfactory answer here.

A “comfortable” life is subjective. It’s going to be based on:

- How much you earn.

- Where you live.

- How much you spend.

- How much you save.

- Your goals in life.

- Your tastes for the finer things.

This stuff is and always will be circumstantial.

However, you still have to do something for planning purposes. You can’t just make a wild guess and hope for the best.

I’m a spreadsheet warrior and have been performing a simple financial planning exercise since I got my first job out of college and had a negative net worth. Here’s what I’ve done since I entered the investment industry 20+ years ago:

Every 3-4 years I do an inventory on where we are financially:

- What do owe?

- What do we own?

- What do we make?

- What’s our savings rate?

- What’s our net worth?

Then I make some assumptions:

- Let’s say our income grows by X% in the coming years.

- Let’s say our savings rate is X% this in the coming years.

- Let’s say our investments grow by X% in the coming years.

Those assumptions include a baseline, a conservative and an aggressive estimate.

I know those numbers are made up but what else can you do? As the old saying goes, I would rather be approximately right than precisely wrong.

Then I map that out over the next 5-10 years.

And every few years I compare the actual results to the estimates.

Maybe the income numbers are better than expected, the returns were about average, and we actually saved less than planned or some other combination of these things. Then I figure out if any course corrections are necessary based on the now updated numbers and current financial situation.

That might mean dialing up or down the savings rate, changing our asset allocation or making no changes (which is what happens most often.)

Our financial planners at Ritholtz Wealth have a much more detailed approach and software programs to utilize with clients but this is the general approach they take as well.

Financial planning requires estimates, assumptions and updates since it’s a process and not a one-time event.

I like the idea of comparing yourself to yourself as opposed to peer benchmarks or made-up goalposts.

It’s also worth remembering that your goalposts will always be moving and that’s OK.

My goals, dreams and aspirations are much different now in my 40s as a family man than they were in my 20s with no responsibilities.

One of my anti-personal finance beliefs is that you never actually figure out what ‘enough’ means to you and that’s OK too. It’s more about finding a range you’re comfortable and content with for the time being.

But your personal goalposts are the only ones that matter truly matter.

Bill Sweet joined me on Ask the Compoud this week to do a deeper dive on this question:

[embed]https://www.youtube.com/watch?v=i42DlcJImg4[/embed]

We also answered questions from viewers on an investor with too much money in CDs, how the new tax bill will impact your taxes, the new $1,000 baby accounts and how to pay no taxes.

Further Reading:

How Much Do Americans Have Saved For Retirement?

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link