Deutsche Bank has a chart that shows we’re looking at the worst 10 year period ever for U.S. government bonds:

That doesn’t seem good.

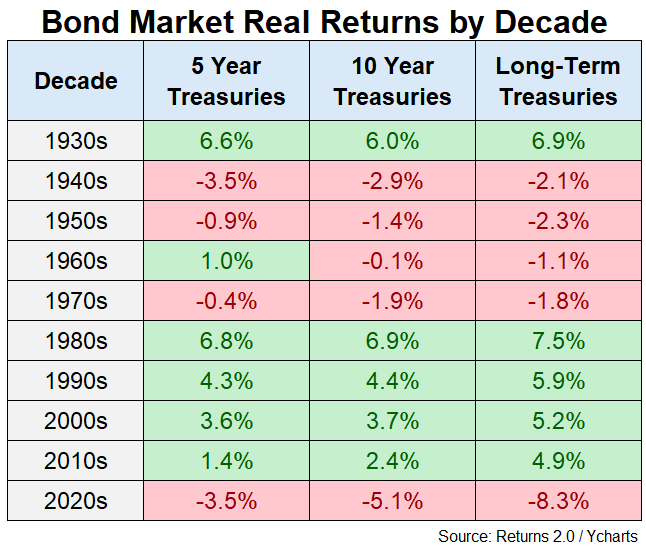

Being a market returns geek I decided to take this a step further by looking at the returns by decade for various maturities in government bonds to see how the 2020s stack up historically.

Here’s the data for 5 year, 10 year and long-term (20+ years) U.S. Treasuries by decade going back to the 1930s:

A little more than halfway through the 2020s we’re on pace for the worst decade in modern economic times.

Not great.

Going from generationally low bond yields to 9% inflation and a massive spike in rates in a short period of time didn’t help.

But it’s actually worse than it appears.

These are nominal returns. The biggest risk for bonds is inflation because they pay you a fixed amount of income over time. You need to look at the inflation-adjusted returns to really understand how things compare over time.

These are the real returns:

A lot of the green from the nominal chart turns red on a real basis.

The most glaring example is the 1970s where you had pretty good nominal returns because yields were relatively high but awful real returns because inflation was so high (which is why rates were high in the first place).

In fact, real returns were negative from basically World War II all the way through the inflationary 1970s as rates and inflation wreaked havoc on fixed income investors.

The 2020s look bad on a nominal and real basis.

This really is the worst decade (so far) ever for government bonds.

How bad is it Ben?!

Long-term Treasuries are still in the midst of a 40% drawdown even after accounting for the income paid out:

They’ve been in a 40% drawdown since 2022!

Why aren’t more investors freaking out about this?

Can you imagine if the stock market got cut in half and failed to make any serious progress for three years? It would be a daily story in the financial press. Investors would be losing their minds. It would be a full-fledged crisis.

You don’t ever really hear anything about carnage in the bond market.

I suppose this is partly because of the way bonds are structured.

You can hold to maturity and be made whole (on a nominal basis).

There were also perfectly good alternatives for those who didn’t want to accept duration risk from longer-term bonds when yields were on the floor:

Short-term Treasuries and T-bills have been a no-brainer alternative with higher yields and far less volatility.1

Another reason bond investors aren’t freaking out is because yields are much higher now than they were when this whole mess began back in the pandemic:

Bonds aren’t a screaming buy by any means but yields in the 4% to 5% range are much better than they were throughout most of the 2010s and early-2020s.

The first half of this decade showed some of the worst returns we’ve ever seen in bonds. Now that we’ve lived through that unpleasant period, expected returns are higher.

Sure, rates could continue their ascent and inflation could come roaring back. That would ding bonds again.

But starting yields are now much better than they were in 2020 so the remainder of the decade should see much better returns from here.2

Further Reading:

Is It Time to Lock in 5% Yields?

1Plus, most investors in long-term Treasuries are pensions, insurance companies and yield speculators.

2Let’s say annual returns for the 10 year are 4.5% for the remainder of the decade, which is close to the current yield. In that case the entirety of the 2020s would be an annual return of around 1% per year.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services.

There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss.

For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link