Santander is cutting mortgage rates by up to 23 basis points tomorrow, while Shariah-compliant lender Gatehouse is lowering rates by up to 20bps.

At Santander, the biggest cuts are on 10-year fixes for remortgage, which will fall by up to 23bps.

It is also dropping prices on two-year fixes for buy-to-let purchase by up to 21bps and for first-time buyers by up to 18bps.

Three-year fixes for first-time buyers will go down by up to 17bps and five-year deals by up to 15bps with new-build options falling by the same margin.

The lender is making lots of other reductions including on buy-to-let and residential product transfers and large loans.

At Gatehouse, rental rates – a Shariah-compliant alternative to interest rates – are being lowered by up to 20bps on two-year and five-year fixed term buy-to-let purchase plans.

Rates now start from 5.64% for a two-year fixed at 80% finance-to-value.

There are reductions to all standard and green two-year and five-year products for new and existing customers, including on houses in multiple occupation (HMO), multi-unit freehold blocks (MUFB) and limited company deals.

Gatehouse head of customer propositions Gemma Donnelly says: “We remain committed to supporting homebuyers and landlords to achieve their property ownership goals within the UK Buy-to-Let market.

“We are confident that today’s changes will help more people to access the home finance products they need and ensure we continue to provide a competitive offering within the market.”

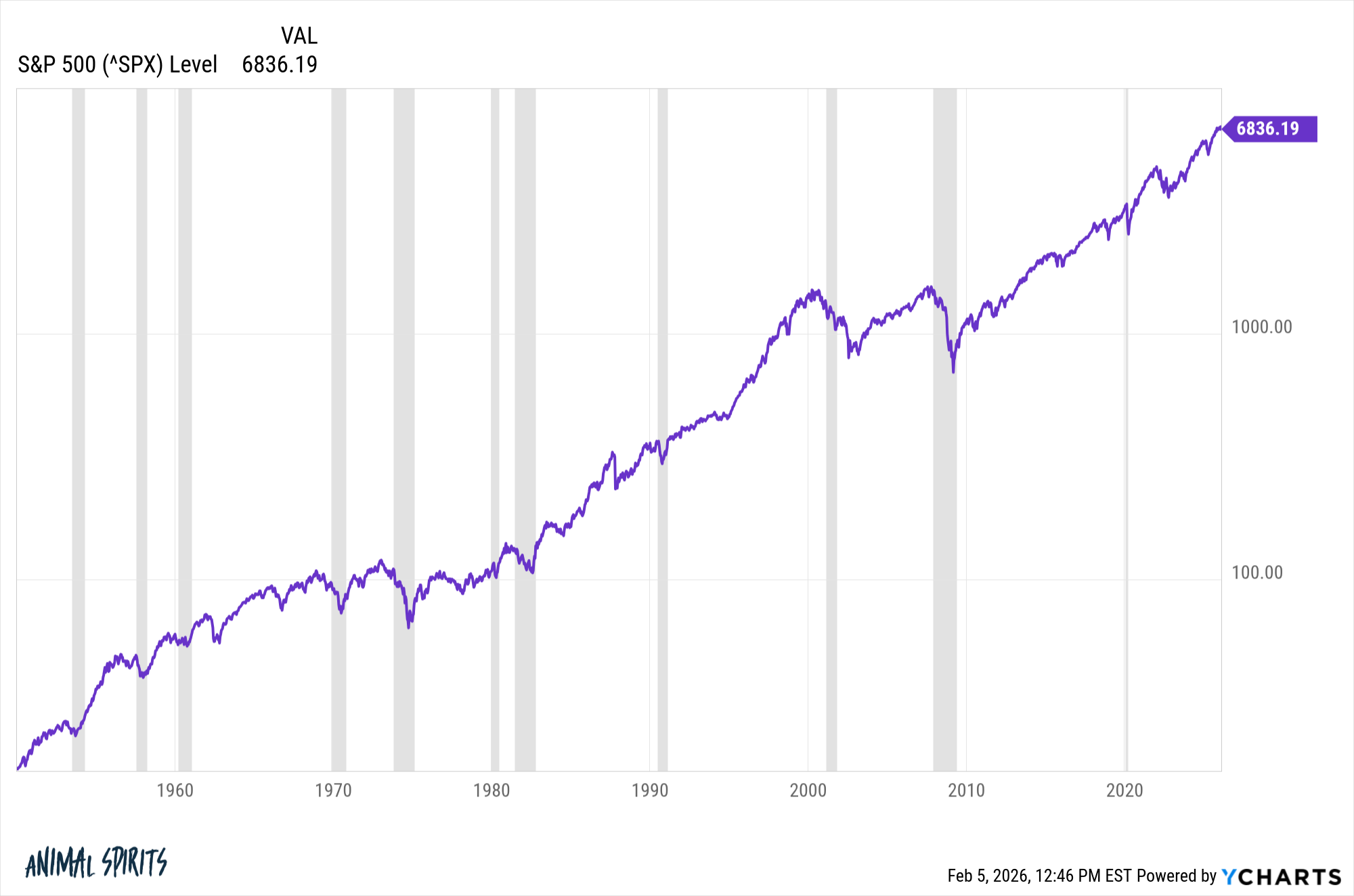

Moneyfacts figures for last week showed that major reductions by lenders are starting to push average rates down.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link