A podcast listener asks:

If there are no iron laws in markets and nothing works forever as an indicator, perhaps studying the stock market is useless?

There are no if-then rules that apply to the stock market that work every time.

If that were the case, everyone would do them, and investing would be easy.

I said nothing works all the time, that doesn’t mean nothing ever works.

Studying stock market history shows you that although the future doesn’t always look exactly like the past, some general rules of thumb can help you be a better investor when applied through a consistent process.

Here are some of my iron laws of the stock market (even if they don’t work all the time):

Volatility is mean-reverting. Periods of high volatility are inevitably followed by periods of low volatility and vice versa.

The stock market wouldn’t offer a risk premium over other asset classes without some volatility, but it can’t last forever. Good leads to bad and bad leads to good…eventually.

It has to be this way or the stock market would cease to exist in its current state.

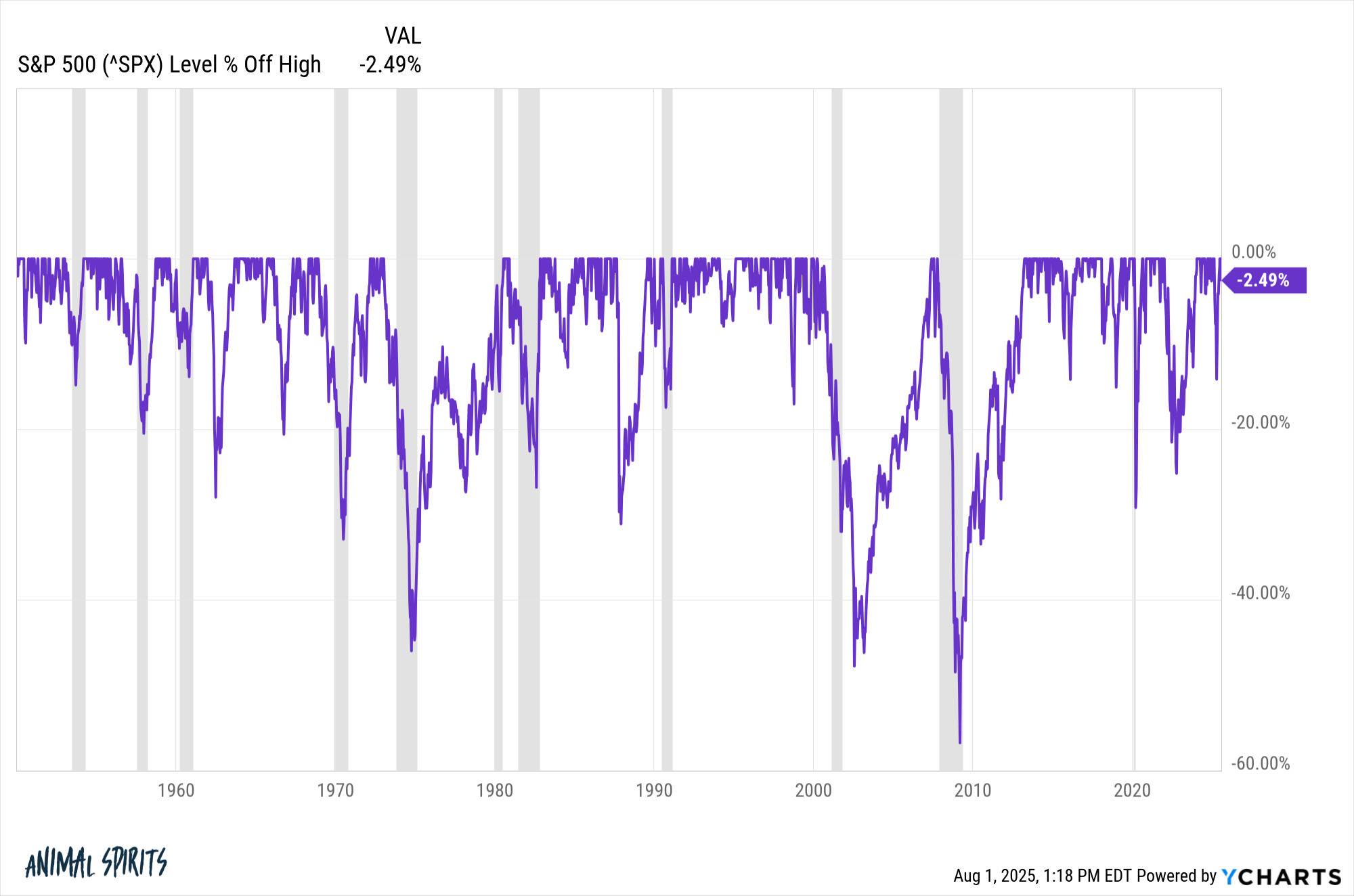

Buy when the stock market crashes. I love stock market crashes because it means you get to invest at lower prices, lower valutations and higher dividend yields. And that usually means higher forward returns.

Can you time the bottom? No.

Could the market crash even further?

Sure.

What if it never comes back? If that happens, we’ll have much bigger problems on our hands.

Diversification is your best hedge against extreme events. Most stocks stink. A small share of stocks account for the majority of the gains in the long run.

Many stocks crash and never come back. Some country stock markets have performed terribly for decades at a time.

The best way to avoid catastrophic losses and survive the stock market is by diversifying your holdings across different geographies, market caps, sectors and the number of stocks you own.

Diversification doesn’t guarantee you incredible results but it does help you stay in the game.

Your biggest edge is not data-driven but behavioral. Don’t try to outsmart the market.

Try to avoid outsmarting yourself.

The stock market has to crash sometimes. This is a feature, not a bug:

No pain, no gain.

The market is hard to beat. It can be done. Most people cannot do it. Invest accordingly.

Risk never completely goes away. There are trade-offs with every investment stance.

If you put all of your money in stocks, your expected returns go up, but so does your chance of large losses and bone-crushing volatility.

If you put all of your money in cash, you can sidestep losses and volatilty but your expected returns go down.

If you have a balanced portfolio, you’re always going to be annoyed with certain strategies or asset classes when they underperform.

Risk changes shape but is never extinguished.

Mean reversion and momentum are here to stay. Some investors hold into losing stocks in hopes they will come back to their original price. Others double-down on the stocks that are going up and trim the losers.

Some investors underreact to market-moving events while others overreact.

Some go with the crowd while others are perma-contrarians.

Fear, greed, overconfidence, recency, and confirmation bias can lead investors to pile into and out of winning and losing stocks all at once.

Human nature means the pendulum swings from one set of emotions to another depending on the price action.

Trees can grow to be very tall but they don’t grow to the sky so mean reversion and momentum will always be with us in some fashion.

Extending your time horizon increases your odds of success. The stock market is the best casino on Earth because your odds of success increase the longer you stay invested.

Markets eventually punish certainty. No one has it all figured out. Once you think you do the market reminds you there is no such thing as easy money.

Michael and I talked about how nothing works all the time and some iron laws of the stock market on this week’s Animal Spirits video:

[embed]https://www.youtube.com/watch?v=K8YT2guvg5M[/embed]

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why Can’t the Stock Market Grow at 15% Forever?

Now here’s what I’ve been reading lately:

Books:

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link