Every week our inbox at The Compound is full of questions from our YouTube viewers, podcast listeners and blog readers.

I wanted to share a handful of the questions we got this week with some thoughts on each:

I have an ongoing personal finance idenity crisis. I tell my kids we are poor, I tell my wife we are middle-class. I tell myself, we are doing better than others. Truth is: I want to buy a Porsche 911-well, a used one and not one of the limited edition REALLY expensive ones.

Your 3 posts in the last couple of months tie very well to this question. (Below) Having been a “car guy” for years but otherwise your classic “millionaire next door”, I struggle with wasting money on depreciating assets. I shop for clothes (and everything else) at Costco. I drive unassuming vehicles. I have owned lower priced toy cars which are fun to drive but otherwise serve no particular purpose.

I don’t own a boat, plane or second home. However, spending around six figures for a mid-life thrill seems like a giant waste of money and invitation for future headaches due to maintenance, insurance and other car costs as I battle the classic logic vs emotional purchase. I realize you can’t take it with you and this is far from an impulse purchase but something I have wanted to do for years. How do you give yourself permission to splurge after a lifetime of saving?

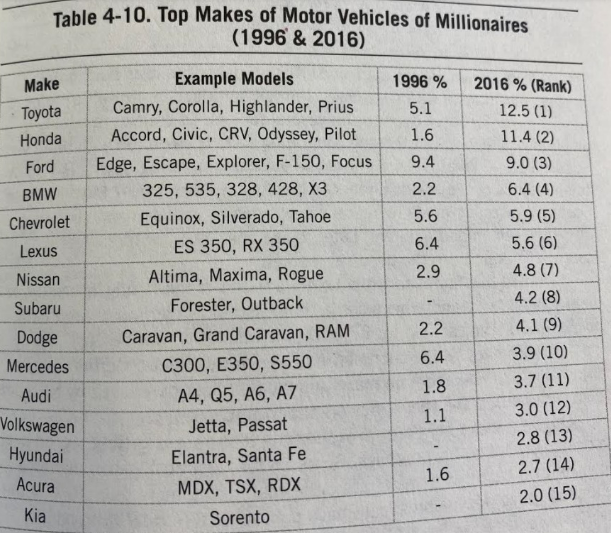

The Millionaire Next Door types drive fairly normal vehicles and brands:

There aren’t a lot of uber-luxury brands.

When it comes to developing good financial habits — budgeting, saving, investing, etc. — it takes time and you have to work at it.

The same thing applies to splurging and enjoying your money.

You don’t go from the couch to running a marathon so why would you ever go from being overly frugal to freely spending money?

You can’t change who you are overnight.

Give yourself 1-2 categories where you’ll go nuts to see how it feels.

Maybe you fly first class on every flight that’s more 2-3 hours.

Maybe it’s some form of self-care like a weekly massage.

Maybe it’s a nice bottle of wine every time you go out for dinner.

Maybe you shop for produce at Whole Foods instead of Aldi for a while and don’t obsess over the cost.

You have to figure out the stuff that’s important to you. Just pick a couple of categories, items or services and try it out.

You could also rent a Porsche for a week to see how it feels. It’s possible the novelty wears off, but you might fall in love and decide it’s worth the splurge.

Just talk to your family about the areas they want to splurge as well. It’s more fun if everyone has their own spending priorities.

I always tell my kids they can get any book they want whenever they want.

That’s one of our splurge categories.

The whole point of delayed gratification is that you allow yourself to feel gratification at a later time. You can still be selectively cheap in some areas while splurging in others.

Maybe a 911 is where you let loose with your money.

Here’s another one:

After college, I used some of my (very limited!) savings to buy Apple shares. This was back in 2008/2009, around the time of the crash. Obviously, they’ve gone up massively in the years since, and I’m super grateful for that.

I sold a little when my wife and I were younger and we needed cash for some major expenses, but for the most part I’ve held onto the stock as it went up. Now I feel a little stuck, even if it’s a good problem to have. The Apple stock makes up a relatively large share of my net worth, maybe 25% or so, which I know isn’t great from a concentration perspective. Yet I kind of hate the idea of paying the 15% tax on my gains if I sell some; I’m not sure what a better investment would be; and also, if I’m honest, I have a little bit of an emotional connection to the shares since they’ve done so phenomenally well for me.

How would you think through what to do next?

I would worry more about having “an emotional connection to the shares” than the concentration risk here.

Adam Smith wrote one of my favorite passages about this in his book The Money Game:

A stock is for all practical purposes, a piece of paper that sits in a bank vault. Most likely you will never see it. It may or may not have an Intrinsic Value; what it is worth on any given day depends on the confluence of buyers and sellers that day. The most important thing to realize is simplistic: The stock doesn’t know you own it. All those marvelous things, or those terrible things, that you feel about a stock, or a list of stocks, or an amount of money represented by a list of stocks, all of these things are unreciprocated by the stock or the group of stocks.

You can be in love if you want to, but that piece of paper doesn’t love you, and unreciprocated love can turn into masochism, narcissism, or, even worse, market losses and unreciprocated hate.

If you know that the stock doesn’t know you own it, you are ahead of the game. You are ahead because you can change your mind and your actions without regard to what you did or thought yesterday.

You don’t have to break up with your stock completely to detach yourself from this emotional connection. Maybe just go on a Ross and Rachel break with part of your allocation by trimming it back to something like 10-15% and see how that feels.

Paying taxes is never fun but it means you won the game of investing and it’s much better than the alternative.

It’s not healthy to develop an emotional attachment to a stock that won’t love you back. And when Apple underperforms that’s going to make it all the more painful.

See how it feels to sell some shares.

One more:

My wife and I hit $1 million net worth last year.

Our annual income is just over $200k/year. We are having a baby in the next 1-2 weeks. We are both 36 years old and thinking about planning for college and retirement. Bought our home 2.5 years ago at $487k with a mortgage rate of 4.85%.

This is ALL not to brag. We live in Atlanta. We don’t know what our next financial milestone is or should be. What do you think we should do next or what should our next financial goal be after hitting seven figures next worth?

This is impressive for a household in their mid-30s.

Here are some ideas for what might come next:

- Increase your savings rate.

- Allow some lifestyle creep into your budget.

- Plan for an early retirement.

- Saving for the kids (529, HSA, etc.)

- Travel.

- Think about a vacation home.

- Home renovations.

- Charitable giving.

- Life insurance.

Having a child can really change the way you think about your goals and desires too so you might just give yourself a little margin of safety by saving more for an unknown future.

Kids are expensive.

It’s impressive to be worth 7-figures at such a young age but don’t get hung up on the numbers.

The same stuff applies at a high level no matter your net worth — defining your goals, risk profile and time horizon.

Your goals can and will change over time especially when you become responsible for a new little person.

I answered these questions and more on the latest episode of Ask the Compound:

[embed]https://www.youtube.com/watch?v=3k_gjvxSbHg[/embed]

Further Reading:

Different Kinds of Rich

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link