One of the biggest trends we’ve seen over the past 15-20 years in the markets is the proliferation of money in the private markets.

All of that money means companies are staying private much longer than they did in the past.

Here’s a chart from Torsten Slok that shows IPOs are far more mature now than they were in the 1990s:

Through some combination of more money flowing to private markets and more onerous regulations for coming public, that means fewer public companies (via Scott Galloway):

A lot of people assume this is one of the big reasons small cap stocks have underperformed large cap stocks for an extended period of time.

Maybe that’s the case.

Over the past 5 and 10 year periods, the S&P is outperforming the Russell 2000 by 4.6% and 5.7% annually!

But these numbers have more to do with the outstanding performance of the S&P 500 than terrible performance by small cap stocks:

Small cap stocks have returned nearly 9% per year over the past decade. It’s been 10% per year for the past 5 years. Those are solid returns. It’s just not as good as the S&P 500 because tech stocks have been so incredible.

Many investors are worried small cap stocks are destined to underperform for good because companies are staying private longer.

However, it’s important to remember that most IPOs don’t make for great investments.

You only hear about the good ones, not all of the failures.

Jay Ritter is a professor at the University of Florida who has extensively studied IPO performance. Take a look at the results:

IPOs have underperformed the stock market by a wide margin. Most of the return comes on the first day when most investors have no shot at getting shares.

You could make the claim that Amazon going public at $400 million back in the 1990s wouldn’t happen today and that makes up for a lot of the underperformance. That could be true but there are a lot of loser IPOs.

Look at how many IPOs go on to offer negative returns:

Nearly 40% of IPOs go on to lose more than 50% of their value from the first closing price!

Almost 60% have negative returns over the average 3 year hold period. Investors in small cap stocks aren’t missing out on IPOs.

Maybe something has changed forever and large cap companies are just better run. They’re more efficient, have higher margins, aren’t impacted by interest rates in the same way, and have the ability to effectively run monopolies. Plus the private companies are coming public at large cap levels.

It’s also possible that these things are just cyclical.

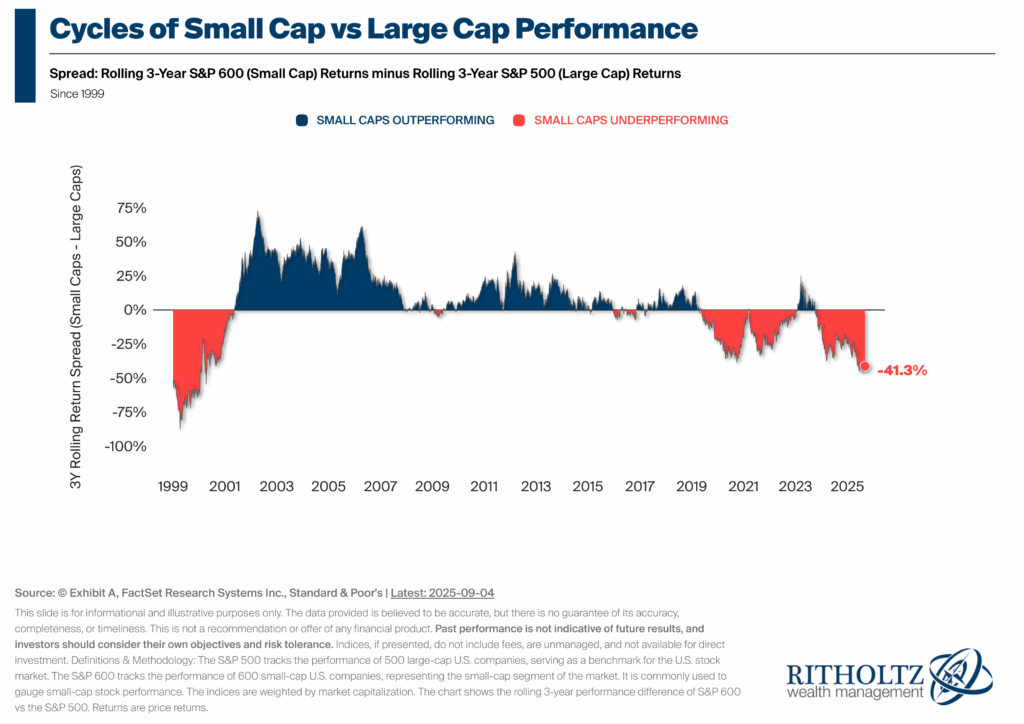

Here’s a chart from Exhibit A that shows the rolling three year over- and underperformance of large caps versus small caps since 1999:

There has been a lot of back and forth this century.

It just so happens that large cap stocks are on a heater of late.1

These relationships aren’t written in stone. Sometimes it really is different this time.

But small cap stocks have done just fine this cycle. It’s just that large cap stocks have been otherworldly.

Can that continue indefinitely?

Maybe.

I wouldn’t bet on it though.

It’s impossible to predict the timing and magnitude of these moves but diversifying among different asset classes helps ensure you’re not invested exclusively in the underperforming segment.

Michael and I talked about small caps, IPOs and much more on this week’s Animal Spirits video:

[embed]https://www.youtube.com/watch?v=skFFsXcDy_s[/embed]

Subscribe to The Compound so you never miss an episode.

Further Reading:

What Happened to Small Cap Value?

Now here’s what I’ve been reading lately:

Books:

1The annual returns this century are much closer than you’d expect. Through 8/31/25 it looks like this: S&P 500 +7.9% and Russell 2000 +7.6%.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services.

There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss.

For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link