A reader asks:

I am a 22-year-old CFA Level 3 candidate. I work as a portfolio analyst for a wealth management team in a multinational bank. I have been working here for about a year, and haven’t found too much pleasure. My team is composed of good people, and I am grateful that I have a job, but I spend most of my days plugging in Excel formulas.

In addition, I’ve always seen myself as an introvert and struggle to talk in large, crowded areas. So, I don’t think becoming a wealth advisor would suit my current skill set. Potential ideas: Risk management, running a fund, or private equity in a blue-collar focused sector? Question: Do you have any ideas on what I should do with my life?

My net worth is about $250-300k.

I started a lawn mowing business in high school and started investing when I was 17 and still mow lawns part-time. My parents recently got divorced, so I have been struggling with depression, and I’m not sure what part of the country my family will live in the near future. Since I’ve been working since 15 y/o and all through college, would you recommend that I take a long break (1-2 months) from work after I pass CFA L3 to clear my head and think about next steps?

This is a lot to process for a 22-year-old old.

You’ve been carrying a lot of responsibility from a very young age and now you’re dealing with a difficult family situation. So my first piece of advice is to give yourself a break. Having a six-figure net worth at your age is an incredible accomplishment.

You’re already a future millionaire.

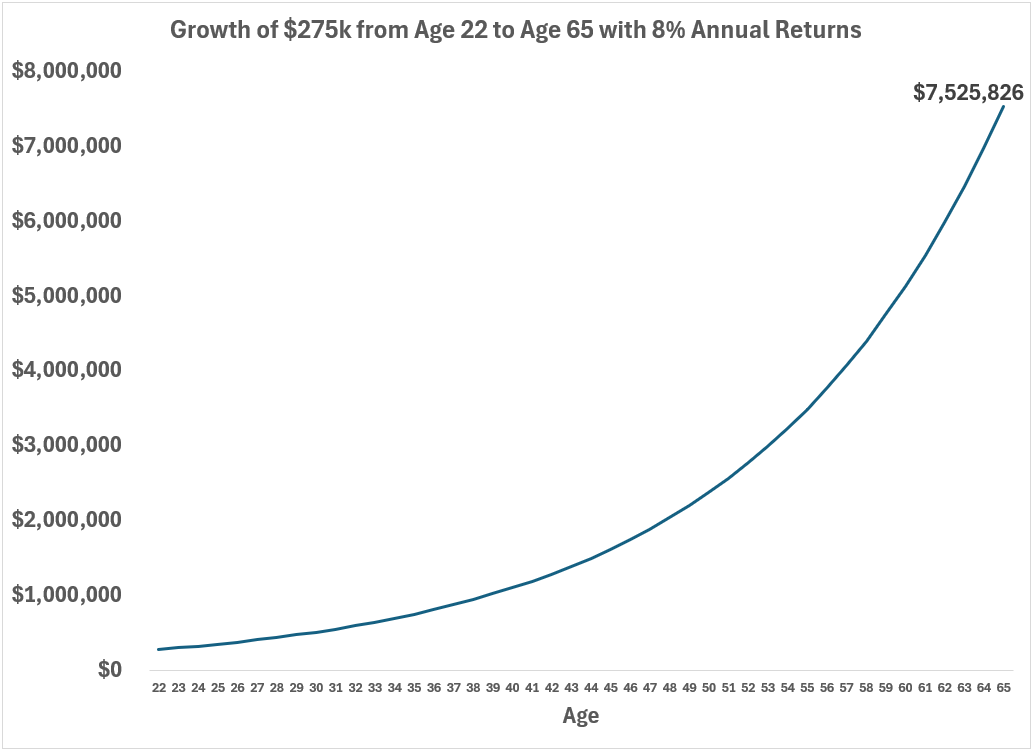

Let’s assume a net worth of $275k.

If you don’t add another penny to that pile of cash and grow it at 8% per year until age 65, you would be worth more than $7.5 million:

That is the beauty of compound capital from a young age. If the savings are front-loaded, the compounding will be back-loaded.

So if you need to take a couple of months off to get your head right, you’re in a position to do that. Take a break if it’s going to help your mental health. That’s what the money is for.

A couple of months out of work in your 20s isn’t going to be the end of the world.

Offering career advice is always tricky but here are some ideas:

Given your introverted nature a role in risk management would make sense. These are quant-heavy jobs so you need a background in math and programming.

You could go for an analyst role at a fund company but those sorts of entry-level analyst positions are kind of a dying breed at the moment. That might be difficult to break into although getting your CFA should help some.

You could also consider going to work in the institutional space for a foundation, endowment, pension or family office. That’s where I got my start and it was a wonderful way to learn about portfolio management and the different fund structures and investment strategies.

The good news is you’re young and can test the waters. There are a lot of different routes you could take in the finance world.

From one introvert to another, I’ll offer you one more piece of career advice — you have to learn how to sell and communicate effectively.

When I was younger I used to look down on sales.

I always had this picture of used car salesman using shady tactics to trick you into buying something you don’t need.

I interviewed at a bank out of college for an analyst role and they told me the title of the role was analyst but it was basically a sales position. No you don’t get it, I’m an analyst! I don’t sell stuff!

But I quickly learned that everyone is in sales whether you like it or not.

The secret sauce of the investment business looks something like this:

- You need analytical chops.

- You need to understand behavioral psychology and human behavior.

- You need to be able to communicate and sell your ideas effectively.

Warren Buffett himself once said, “The most important skill in finance is salesmanship.”

In many ways, sales and marketing really are everything.

Finding a good job is about selling yourself and your strengths. Finding a spouse is about marketing your good qualities. To put forward the thoughts and ideas that you care about you have to be able to convince other people that your opinions matter. This is especially true when you’re first coming up in the working world and are short on experience.

Networking plays a huge role for many when finding a job these days so you have to have the ability to convince others that they should make a sale on your behalf.

Let’s say you decided to run your own fund someday. Do you think it’s all about analyzing companies and picking stocks?

You have to sell your strategy to investors too. Why do you think all of these fund managers are on CNBC all the time!

Every prediction, stock pick and macro forecast is a sales tactic to bring in new investors or keep current investors happy.

And if you’re an analyst at one of these funds you better be able to sell your investment ideas to the rest of the team.

The thing that really clicked for me is once I found something I was passionate about it didn’t feel like sales anymore. I love writing and talking about the markets, asset allocation and investor behavior.

You just have to find a company, group of people or firm that fits your values and belief system. It doesn’t feel like sales if you believe in the message.

Plus, you already have the ability to communicate and sell. You somehow found clients for your landscaping business.

In the short-term, give yourself a break if it’s going to put you in a better place mentally.

In the long-term, you need to become more comfortable communicating with large groups of people.

It’s part of the job.

I covered this question on an all-new episode of Ask the Compound:

[embed]https://www.youtube.com/watch?v=ajaPhM_lsKY[/embed]

We also discussed questions about Fed rate cuts and your portfolio, Social Security, where to stash real estate profits and how to set long-run return expectations.

Further Reading:

The Secret Sauce of the Investment Business

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link