America is the richest nation the world has ever seen and we just keep getting richer.

Midway through 2025, the Federal Reserve pegs total household wealth at just shy of $170 trillion:

When it comes to wealth, the United States is the envy of the world.

There was a story in The Telegraph recently that sought to understand why American households are so much richer than people in Great Britain. Some stats from the article:

- 40% of U.S. households had leftover earnings after tax of at least $94k. Just 10% of households in the UK had that much disposable income.

- The top 10% level for disposable income in Britain is $95k. It’s more than twice as much in the U.S. at over $205k.

The top 10% in the U.S. have more disposable income than the top 5% in the UK.

- The top 10% in the UK have seen disposable incomes stagnate on a real basis since the Great Financial Crisis, while the top 10% in America have seen inflation-adjusted disposable income rise by nearly 30%.

So why are we inundated with headlines like this:

And this:

America is an objectively rich country. Why don’t more people here feel rich?

Some ideas:

Where you live matters. MERIC looks at housing, transportation, groceries, utilities and healthcare costs to create a cost of living index by state:

It’s no surprise that places like California, New York, Massachusetts and Hawaii are super expensive places to live.

In some of these places you are compensated for a higher cost of living but that’s not everyone. There are plenty of people who make an income that would place them at the higher end of the distribution nationally who don’t feel all that wealthy because their money doesn’t go very far.

Ironically, living in a rich place can make you feel less wealthy.

Inflation matters. The high cost of housing makes it extremely difficult for those who didn’t own a home before 2022:

Monthly payments on the median home at current mortgage rates are now roughly double what they were before the pandemic.

The cost of a new vehicle is now more than 22% higher than prepandemic levels:

Everything now costs more than it did (besides TVs).

Wages have kept pace with inflation but that’s on average. It’s not everyone.

The reason wealthy people have been able to spend throughout the tumult of the 2020s is because they own most of the financial assets.

If you don’t own any financial assets you’re probably treading water at best.

Inflated expectations. Personal finance people take the idea of lifestyle inflation way too far. They never want you to spend more money.

As long as you’re earning more you should be spending more (and saving more) as the pie grows bigger.1

But you can’t let your expectations of what you deserve grow faster than your income.

I deserve the bigger house. I deserve a new Ford F-150 every three years. I deserve to go on vacation to the Amalfi Coast every summer. I deserve to send my kids to private school.

Merit has nothing to do with it.

Can you afford it?

Are you still able to save and invest while spending money on these desires?

If your burn rate is higher than your take-home pay, it doesn’t matter how much money you make. You will always feel like you’re falling behind…because you are.

The hard part about living in the information age is that it’s never been easier to benchmark yourself to people who are doing better than you. There are always people on social media bragging about the size of their portfolio, house and vacations.

It’s never been harder to stay in your own lane.

There are always people richer than you are. If you’re on the bottom of the wealth and income scale you have a right to feel leftout right now. But there are people who are objectively rich who don’t feel rich for a variety of reasons.

One of them is the fact that the rich keep getting richer:

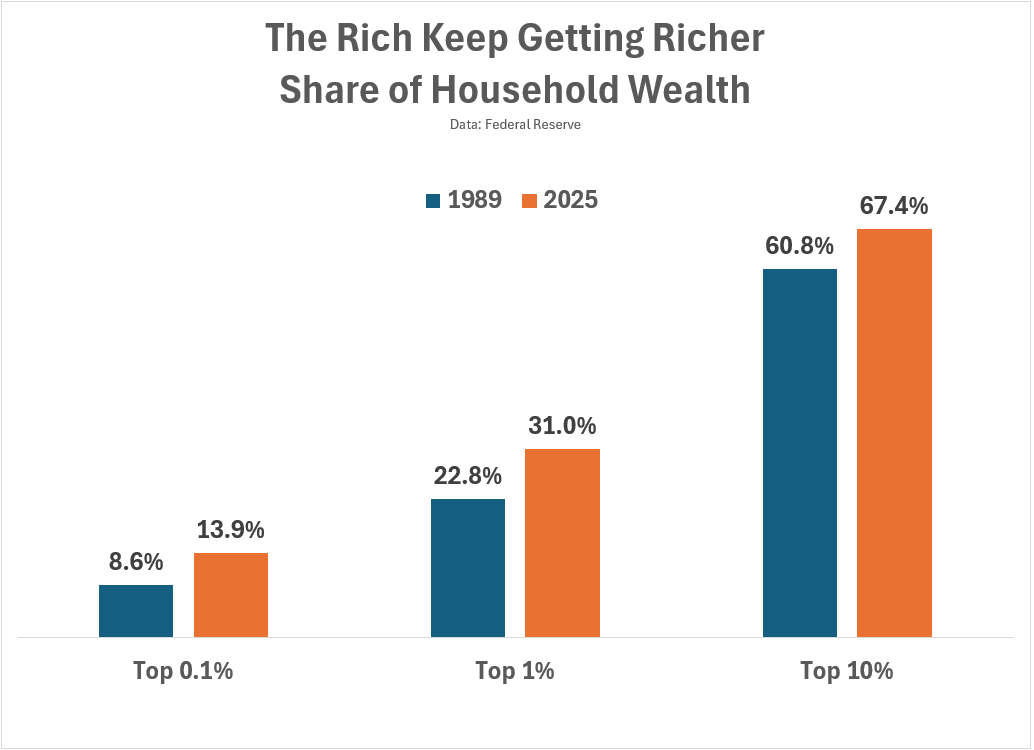

Just look at how the top of the heap has evolved over the past 3-4 decades:

The top 10% as a cohort has gained a much bigger slice of the wealth pie.

But all of the gains have gone to the top 1% of the distribution. And most of the gains for the top 1% have accrued to the top 0.1%.

If you’re in the top 10% in America that puts you in the top 1% worldwide.

But if you’re in the top 10% you really want to be in the top 5%.

If you’re in the top 5% you really want to be in the top 1%.

If you’re in the top 1% you really want to be in the top 0.1%.

Regardless of how much wealth you currently hold, if you’re only desire is to gather more and more money you will never be satisfied.

Further Reading:

The Vibes Are Broken

1Keep your saving and spending rates the same and you’ll both save and spend more as you make more. There are other factors at play (taxes) but that’s the idea.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link