As more consumers feel the impact of holiday spending on their budgets, PayPal is launching its buy now, pay later service in Canada.

Customers will be able to split purchases between $30 to $1,500 into four installments, as long as the merchant is a PayPal partner. One of the goals of the launch is to give consumers another payment option during tough economic times, as many have turned to installment loans to navigate financial quandaries.

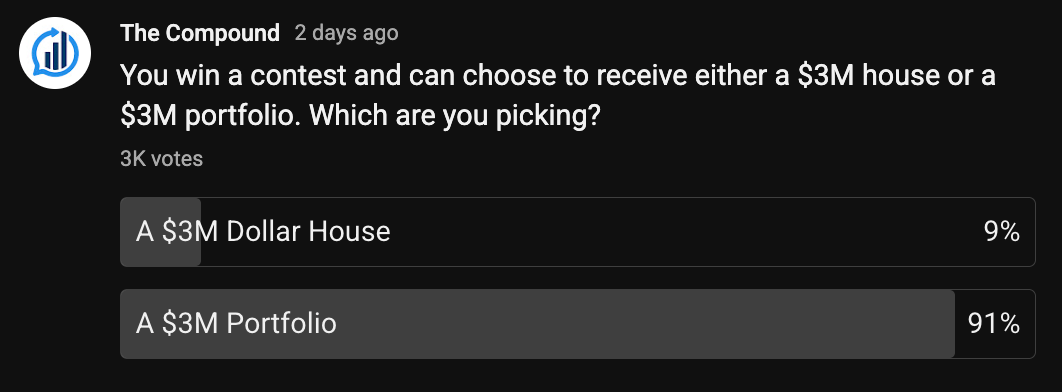

However, PayPal is entering a market already served by Affirm, Klarna, and Afterpay, which have established BNPL offerings in Canada. Still, PayPal has managed to achieve approximately 20% quarter-over-quarter volume growth in the highly competitive U.S. market, where these same rivals operate.

A Need for Alternatives

PayPal recently expanded its U.S. offering to let customers make in-store purchases using BNPL—previously available only for e-commerce transactions. To encourage adoption during the holiday season, the company is also offering 5% cash back on all BNPL purchases through the end of the year.

Consumers have shown growing interest in alternative payment methods.

PayPal highlighted this in its research, which found that roughly 60% of U.S. consumers are more concerned about holiday spending this year, while over 80% of shoppers who have used or considered BNPL plan to use it for holiday purchases.

A Popular Refuge

BNPL has become a popular lifeline for consumers, largely because these products typically involve low or no fees and often don’t require credit checks.

While concerns persist about potential misuse and the need for stronger regulatory oversight, BNPL loans seem destined to play a substantial role this holiday season. According to Adobe, BNPL purchases on Cyber Monday are projected to reach $1 billion for the first time.

This trend could benefit merchants who view BNPL as a tool to increase average order value. And for Canadian customers, it could enhance cross-border purchasing power, as they’ll now be able to use BNPL at U.S. based-merchants within PayPal’s ecosystem.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link