E*Trade (Morgan Stanley Private Bank) is running promotions for new customers on both their savings and checking accounts:

Savings promo details.

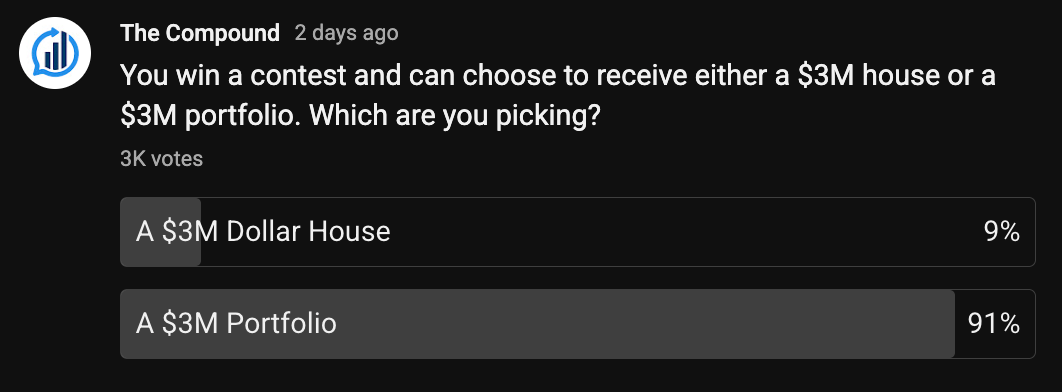

- Offer is valid for new E*TRADE from Morgan Stanley clients who open a Premium Savings Account by 2/28/2026 with a deposit of $25,000+ of qualifying new money within the first 30 days after account opening. See tiers below. Use promo code SAVE100.

- Maintain an average daily balance in your enrolled Premium Savings Account that meets the Minimum Maintenance Balance of your Deposit Tier. The average daily balance calculation will begin from Day thirty (30) of account opening and will end forty-five (45) days following (“Maintenance Period”).

- After the requirements are satisfied, E*TRADE will deposit the bonus within thirty (30) days following the end of the Maintenance Period.

If your deposit meets the minimum of a tier exactly ($25k, $50k, $75k, $100k) then it works out to a 1% bonus ($250 on $25k, etc).

If let’s say you hold for 60 days for some wiggle room, that works out to a 6% bonus on an annualized basis. Add on the current 3.75% APY on the Premium Savings account for a total of 9.75% APY. Not bad.

Checking promo details.

- Open one new Checking or Max-Rate Checking Account from Morgan Stanley Private Bank by the end of the offer period (currently 12/31/25). You must apply promo code CHECKING25 at the time of account opening.

No minimum initial deposit is required to open an account. However, account must be funded within 30 days to remain open. You are not eligible if you have or had owned or co-owned (joint) a Checking or Max-Rate Checking Account within the last 12 months from when you enroll in this offer.

- Set up and receive at least two Direct Deposits each of $1,500 or more to your Checking or Max-Rate Checking Account within 90 days from account opening.

- Your bonus should arrive around 120 days from account opening.

As of 11/10/2025, Max-Rate Checking Account pays 2.00% APY. You must maintain a $5,000 average monthly balance, otherwise there is a $15 monthly fee.

The basic Checking Account only pays 0.05% APY (basically nothing), but has no minimum balance.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link