A reader asks:

Ben has been harping on the people who pay off their mortgage early. Does that mean he’s a fan of the 50 year mortgage idea floated by the Trump administration?

The U.S. Director of Housing says the government is looking into 50 year mortgage loans:

Will it ever happen?

I don’t know but that’s not going to stop me from running the numbers.

The initial reaction to this proposal was pretty negative across the board. Personal finance people despise this idea.

Let’s look at the numbers to see why.

I like round numbers so let’s look at a $500,000 mortage at a 6% fixed rate over 30 and 50 years:

The monthly payment is a little lower but the lifetime interest paid is way higher.

Now let’s look at the monthly payment profile to see why a 50 year mortgage isn’t the greatest in terms of building equity.

This is the payment split between principal and interest for a 30 year mortgage at 6%:

At the outset you’re paying 83% of your payment to interest costs and 17% to pay down principal.

This is how amortization works on a loan of this length.

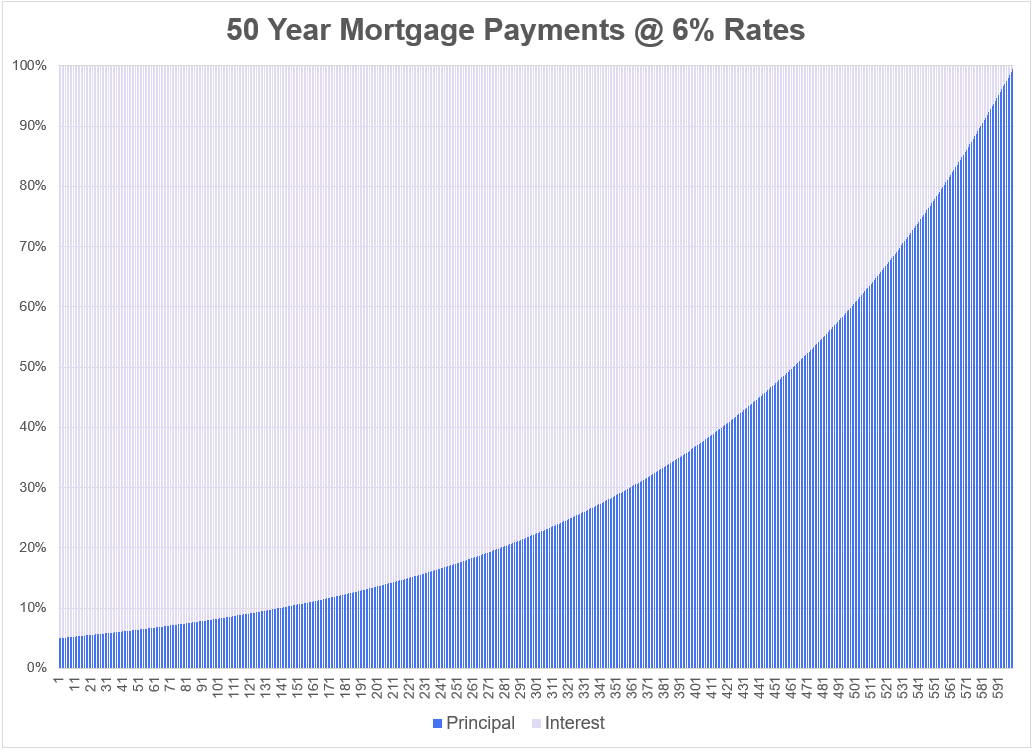

Now let’s look at the 50 year mortgage:

Basically the entirety of your payment at the outset — 95% — goes towards interest expense. It takes a very long time to make a dent in your principal balance.

After 10 years, this is the amount of equity you would have in the home for each mortgage duration:

- 30 year: $81,571

- 50 year: $21,636

This is the biggest problem people have with a 50 year mortgage. You don’t really build any equity outside of home price growth.

And this example is using the same interest rate for both durations. Right now 30 year mortgage rates are roughly 0.5% higher than 15 year mortgage loans:

You would assume a 50 year mortgage would have a higher rate than the 30 year.

If there were a 40 basis point spread between the 30 year and 50 year borrowing rates, you would only save $217/month ($2,998 vs. $2,781) in my simple example.

It doesn’t move the needle significantly in terms of affordability.

That’s the glass-is-half-empty take.

Now allow me to play Devil’s Advocate.

No one is staying in a house for 50 years. The average homeowner tenure in America is somewhere between 10 and 12 years. Therefore, you would have to view a 50 year mortgage like an interest-only loan that allows you to lock in a mortgage payment and hedge against rent inflation.

That’s not a terrible way to look at this but it’s still sub-optimal. If the idea is to fix the housing market and make it more affordable for young people to buy, this is not the answer.

This is like a Band-Aid on a machete wound.

If we’re just going to throw ideas against the wall to see what sticks here’s mine:

Why don’t we offer any first-time home buyer a one-time 3% mortgage rate?

It’s not your fault if you missed generationally low interest rates in the early-2020s because of bad timing in your life stage. Lower mortgage rates would have a much bigger impact on the finances of first-time homebuyers than 50 year mortgages.

Here’s the tale of the tape for a 6% and 3% loan on a $500,000 mortgage over 30 years:

The monthly payment and the total interest paid are way lower.

Now look at the payment profile:

This is why 3% mortgage rates are likely one of the best personal finance assets households have ever seen. You get such a higher percentage of your payment going to principal paydown than you do with a higher rate or longer duration loan.

The government, most likely Freddie and Fannie would have to back these loans. Or maybe the Fed could buy mortgage-backed bonds to bring mortgage rates down.

I know it doesn’t seem fair for the government to tinker with the housing market but that’s exactly how the middle class was built out in the 1950s.

The government guaranteed the loans of the homebuilders to take the risk off their shoulders. They offered VA mortgage loans to the soldiers who came home from WWII. They incentivized the building of more homes.

Obviously, building more homes would be a far more desirable solution for everyone.

Increasing the supply of homes would relieve a lot of the pressure on buyers. The federal government should incentivize local governments to modify their zoning restrictions to facilitate the construction of more housing without unnecessary red tape.

If we’re going to deregulate, the place it matters most is housing.

Financial engineering is easier than building in the physical world but building more housing actually works.

Until that happens we’re going to have to get creative unless we want all of our young people to to revolt because they can’t afford to buy a house.

We broke down this question on the latest edition of Ask the Compound:

[embed]https://www.youtube.com/watch?v=Svi2jz-vlSk[/embed]

Jonathan Novy from Ritholtz Chicago joined me on the show this week to discuss questions about the Kyle Busch insurance scandal, sequence of return risk in retirement, asset allocation decisions and learning vs. earning early in your finance career.

Further Reading:

Housing Market Nobility

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link