According to The Wall Street Journal, there are more 401k millionaires than ever:

The 401(k) millionaire club is growing.

Steady saving by many Americans and a third consecutive year of big gains for U.S. stocks have swollen account balances. As 2025 comes to a close, many individual investors are finding holiday cheer in statements showing they have crossed the $1 million milestone.

As of the third quarter, there were 654,000 401(k) millionaires at the brokerage Fidelity, the highest level in records going back to the early 2000s. Around 3.2% of more than three million accounts tracked by benefits provider Alight had balances above $1 million as of the third quarter, double the figure at the end of 2022. At T.

Rowe Price, roughly 2.6% of participants had balances above $1 million, up from 1.3% at the end of 2022.

That’s a relatively small amount relative to the total but impressive nonetheless considering most people change jobs, have other investment accounts, don’t stay in the same 401k plan forever, etc.

It also makes sense in a long-lasting bull market.

Of course, like many house-rich millionaires, you can’t exactly spend down your 401k unless you’re retired or willing to pay the taxes and penalties. Most of this new wealth cohort are called “moderate millionaires,” with assets ranging from $1 million to $5 million.

UBS estimates these moderate millionaires have quadrupled since 2000 to 52 million this year. One thousand moderate millionaires were added every single day in the U.S. in 2024:

I think we should celebrate this rising number of everyday millionaires. This is a positive development.

But there is a difference between rich and RICH:

“Popular culture still thinks of millionaires in terms of Scrooge McDuck or the top-hatted icon of Monopoly,” wrote Paul Donovan, chief economist at UBS’s wealth-management practice, in a note to clients this year. “The new dollar millionaires have broken a psychological wealth threshold, but their income and spending is that of middle class households.”

Spending like a “stereotypical millionaire” probably requires at least $5 million, he said.

Fair enough.

Here’s the thing though — you don’t become a millionaire by spending money like a millionaire!

You become a millionaire by saving and investing, not spending! Wealth is a lack of spending.

This is not a new concept.

The Millionaire Next Door came out in 1996.

These are the attributes of most moderate millionaires:

Being a millionaire does not mean you spend $1 million. It means you save $1 million.

For most people, becoming a millionaire requires sacrifice, hard work and patience.

Sure, there are people who win the metaphorical lottery through speculation, family money or luck. They have an obscene amount of wealth and they spend obscene amounts of it.

But most people build their wealth over the course of many years by saving, investing and compounding.

And one of the reasons people are able to compound their capital through patience is because tax-deferred retirement plans make it difficult for you to access the money. It’s a feature, not a bug.

Spending your money should be part of any healthy financial plan.

But most people won’t become any kind of millionaire if they don’t save first.

Michael and I talked about 401k millionaires, moderate millionaires, money vs. meaning and more on this week’s Animal Spirits video:

[embed]https://www.youtube.com/watch?v=Z7A--Jyc_bE[/embed]

Subscribe to The Compound so you never miss an episode.

Further Reading:

Max Out Your 401k

Now here’s what I’ve been reading lately:

Books:

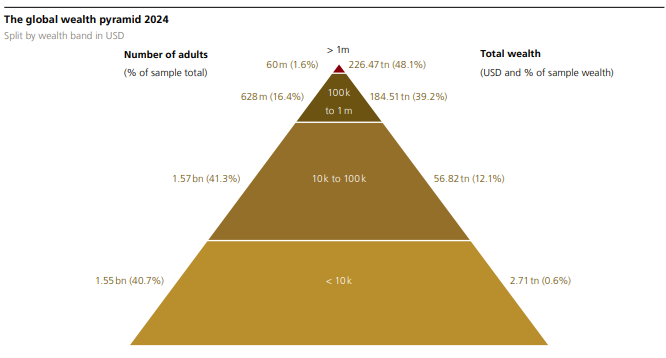

1UBS also shows that 60 million households (1.6% of the global population) hold nearly 50% of the wealth in the world.

The top 18% owns 87% of the wealth.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision.

Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.

Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link