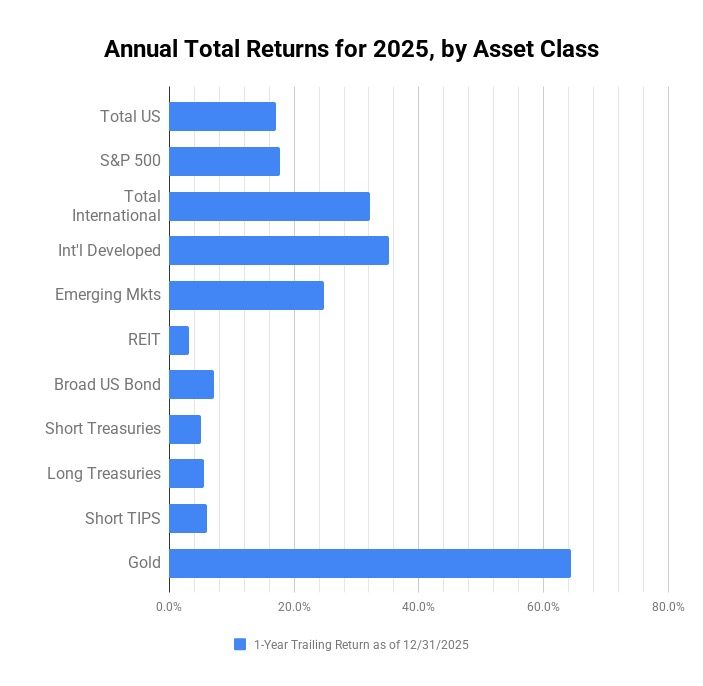

2025 saw positive returns for every broad asset class that I track. Per Morningstar, here are the total annual returns (includes price appreciation and dividends/interest) for select asset classes as benchmarked by popular ETFs after market close 12/31/25.

I didn’t include Bitcoin or any other crypto because I don’t track them as a long-term asset, only own small amounts temporarily, and would not advise my family to own it. However, I do acknowledge that it went down slightly this year.

Meanwhile, Gold went up by a lot this year, which indicates to me that Gold and Bitcoin have some very different characteristics. Very few developed countries are buying large amounts of Bitcoin to store in their central bank vaults.

The “set and forget” Vanguard Target Retirement 2055 fund (VFFVX), currently consisting of roughly 90% diversified stocks and 10% bonds, was up 21.4% in 2025.

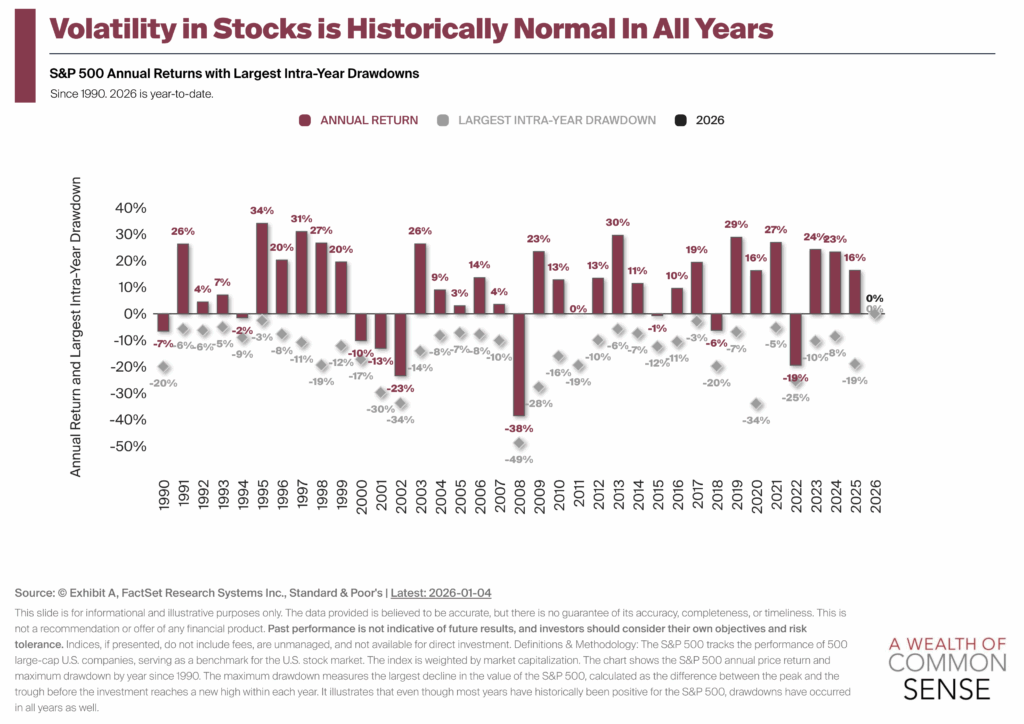

Commentary. 2024 yet again shows that you want to stay in the game.

There are always going to be reasons to be afraid: because US stocks continue to have historically high valuations, because you’re worried about an AI bubble, or worried that AI will instead take your job…

Here are your cumulative returns through the end of 2025 if you had been a steady investor in the Vanguard Target Retirement 2055 for many years despite the many, many problems of the world:

(These work great inside 401ks and IRAs. I’d avoid buying Target Retirement mutual funds in a taxable account.)

I feel the need to promote slow compounding over all the short-term madness around us. Sports gambling. Risky options trading.

Crypto joke coins. Buy Now Pay Later. I tell my kids that it’s perfectly okay to avoid some stuff completely. You don’t need to try it to know it’s a bad idea.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link