After years of uncertainty, crypto and digital assets have finally reached mainstream acceptance. However, growing pains continue.

Research from the UK Cryptoasset Business Council (UKCBC) found that 40% of transfers between UK crypto exchanges and bank accounts are often blocked or delayed.

These issues frequently arise due to blanket bans or transaction caps that financial institutions have implemented to protect against fraud. Yet, these problems still occur even when customers use crypto platforms licensed by the UK’s Financial Conduct Authority.

As crypto adoption grows, the issue appears to be worsening. After analyzing transactions at 10 of the UK’s largest exchanges, UKCBC found that eight firms reported a measurable increase in customers experiencing blocked or limited transfers last year, while none saw a decrease.

Stymied Innovation

While fraud is a persistent concern for financial institutions worldwide, crypto advocates argue that blanket blocks and limits could stifle innovation and reduce the competitiveness of UK banks.

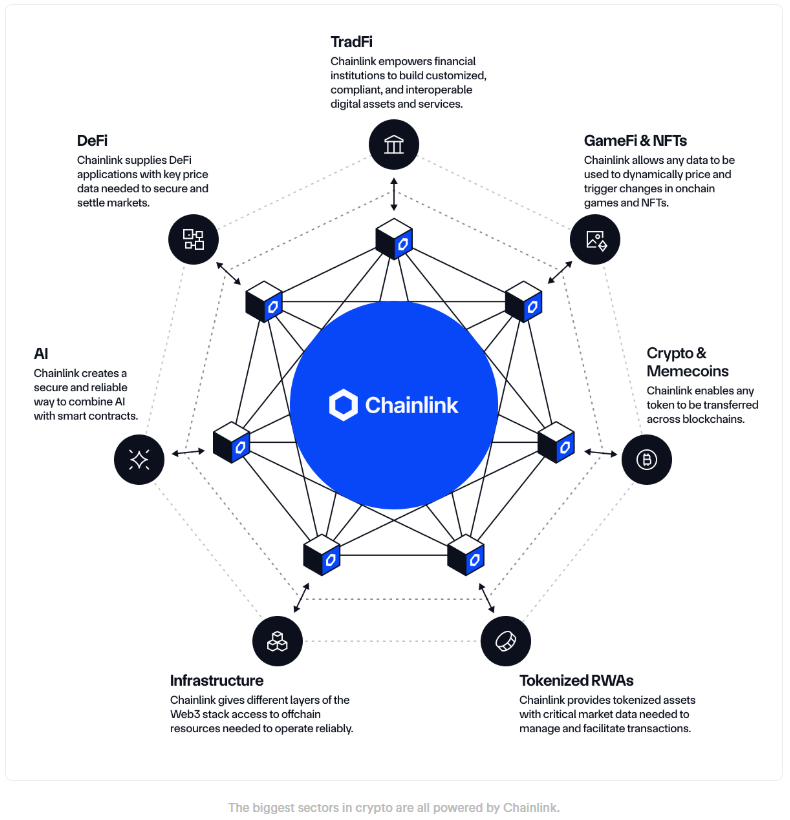

Thanks to the capabilities of digital assets, many leading financial institutions have invested in technologies like blockchain, tokenization, and stablecoins to varying degrees.

For example, top UK bank Barclays recently acquired a substantial stake in U.S.-based stablecoin settlement platform Ubyx, a move designed to integrate digital assets with the financial services industry’s regulatory standards.

Mirroring Obligations

This is just one example of the substantial institutional investment in crypto and digital assets in recent years.

In response, many crypto companies have overhauled their compliance standards and fraud defenses to align with the obligations of their banking partners.

As crypto exchanges and fintech companies assume a greater role in the industry, the U.S. Federal Reserve has even considered creating dedicated “skinny” master accounts that would give these firms direct access to Federal Reserve services without requiring a bank intermediary.

This growing acceptance of crypto platforms by banks, fintechs, and regulators suggests that imposing broad limits and blocks on crypto companies is counterproductive. At minimum, the UKCBC recommends that UK banks adjust their policies to differentiate between licensed and unlicensed crypto companies.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link