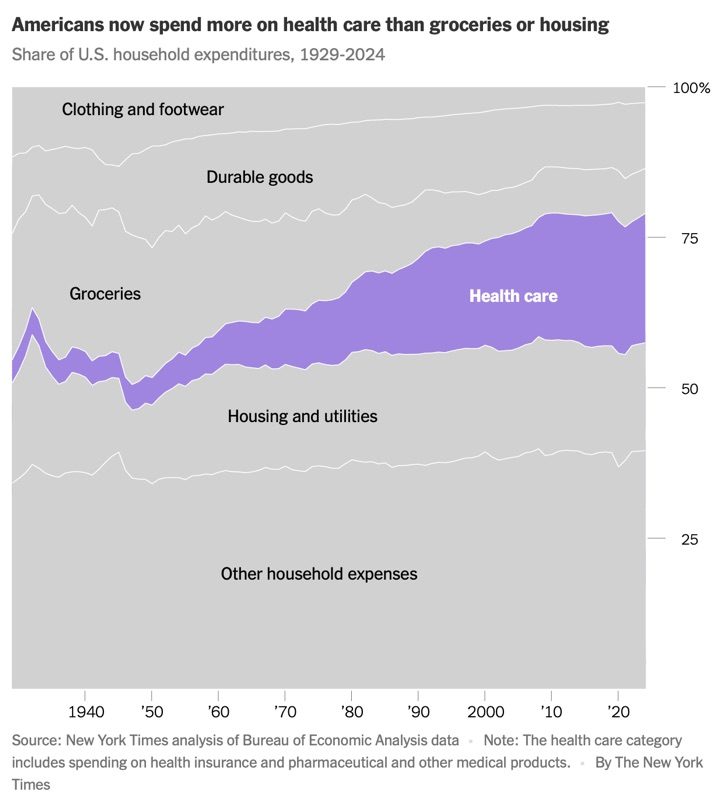

Housing has always been considered the biggest expense in a family’s budget. More recently, everyone’s grocery and restaurant bills have skyrocketed, bringing food costs into focus. But the biggest item in your budget is very likely to be healthcare, even if it is often disguised by your employer’s direct payment of part of the premium.

(Although employers seem to cover less and less every year… Employers love Health Savings Accounts (HSAs) as it allows them to justify pushing lower-cost high-deductible health plans (HDHPs) wherever possible. If you are a family with a kid with ongoing medical needs, HSA+HDHP does not work out to be a good deal.)

The NYTimes article How Health Care Remade the U.S.

Economy (gift) shows us how this came to be over time. Healthcare costs include insurance premiums as well as drugs and other medical products.

As someone who has been thinking about early retirement since they were 25 years old, I am well aware that health insurance premiums for our family of 5 is roughly $25,000 a year. I’m not even counting our actual healthcare expenses like co-payments and deductibles. Healthcare has always been a huge expense to offset with investment income.

Some people try to keep their modified adjusted gross income low and use ACA subsidies, check out this KFF ACA calculator to estimate your numbers.

Note that the ACA income “cliff” is set to return in 2026, meaning household incomes exceeding 400% of the Federal Poverty Level (FPL) will not be eligible for any ACA premium subsidies.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link