They say the stock market is forward-looking.

They also say the stock market has predicted 9 of the last 5 recessions.

So which one is it?

Is the stock market all-knowing?

Or is it just as bad as any of us when it comes to seeing around the corner with what’s coming next?

It’s a little bit of both.

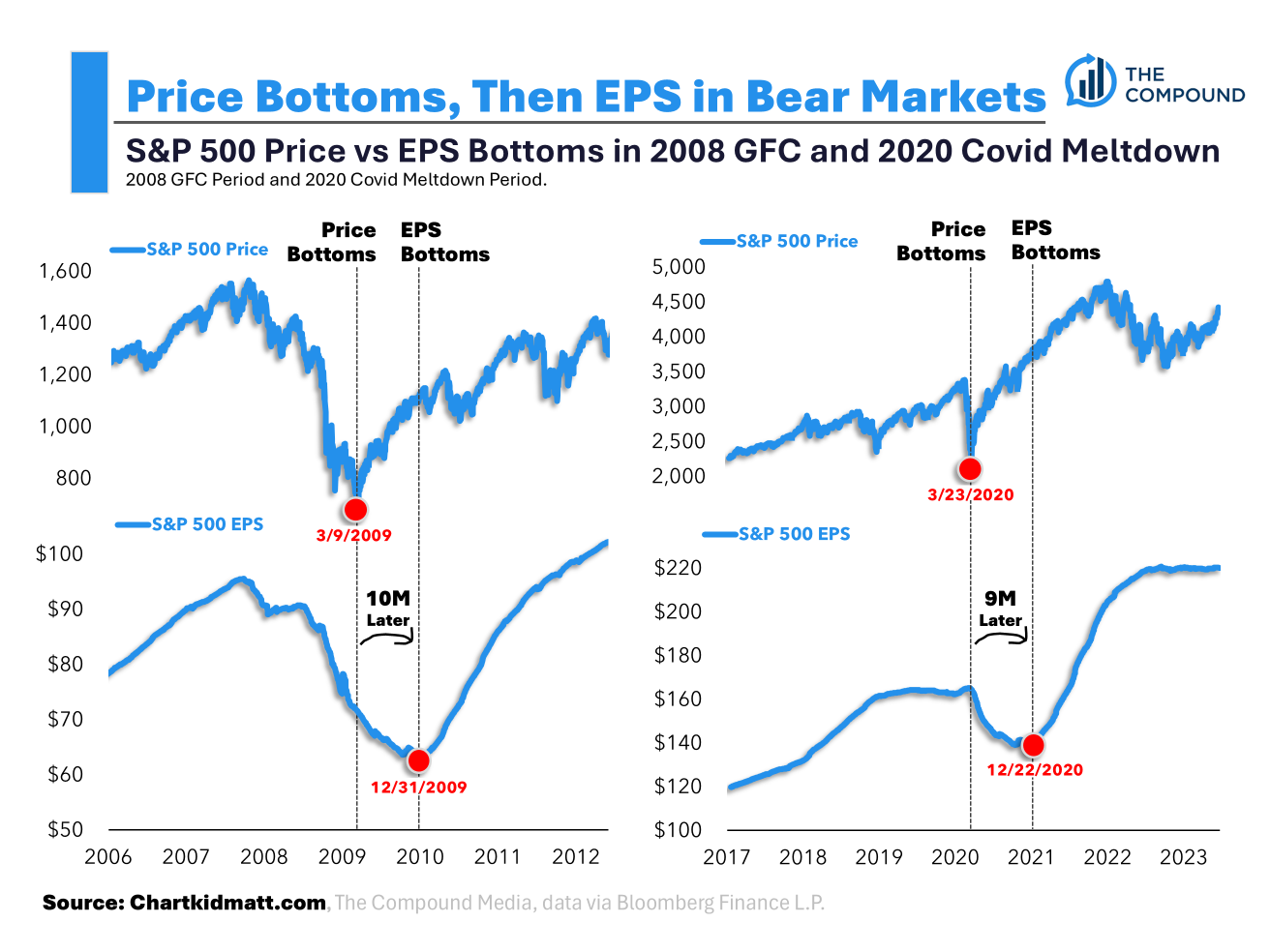

Chart Kid Matt has this great chart on his new blog that shows the stock market tends to bottom before earnings in a bear market:

On average, stocks front-run the earnings rebound by 9 months.

Just look at the 2008 and 2020 downturns to see how this played out in practice:

The stock market turned higher well before corporate earnings bottomed. The market saw the turnaround coming before it even happened!

This is one of the reasons it can be so difficult to invest in a bear market. The news keeps getting worse even when stocks start going up again. Everyone thinks it’s a dead cat bounce because earnings keep going down.

It’s a leap of faith buying during a bear for a reason.

You have to trust that the market knows something no one else does.

However, the stock market is not quite Nostradamus when it comes to picking the end of a bull market.

The stock market and earnings tend to peak around the same time when the bull market ends.

Look at what happened at the peaks in 2007 and 2020:

Stocks and earnings more or less run concurrently at the tops.

There’s not much of a signal there since they both rollover together.

So the stock market is better at predicting bottoms than tops.

No one’s perfect.

This is what makes investing equal parts interesting and difficult.

Investing when stocks are down requires a leap of faith because you have to assume the market knows something the headlines don’t.

And investing when stocks are up requires a leap of faith because you have no idea when the rug will get pulled beneath your feet without warning.

This is one of the reasons stocks offer a risk premium over other asset classes.

If investing in stocks were easy, you wouldn’t earn high returns over the long run.

No risk, no reward.

Further Reading:

How Bear Markets Work

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision.

Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees.

Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link