Taxes

Tax Benefits of Health Savings Accounts

Key Takeaways HSAs provide triple tax advantages with tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. To...

MMB Portfolio Dividend & Interest Income – 2025 Year End Update — My Money Blog

Here’s my 2025 Year-End income update as a companion post to my 2025 Year-End asset allocation & performance update. Even...

What is the Safe Harbor Rule for Underpaying Estimated Tax?

Key Takeaways Safe harbor tax rules protect against IRS underpayment penalties, not balances owed, by meeting specific payment thresholds during...

Apple Watch Standalone Phone on US Mobile Review — My Money Blog

My older two kids do not have smartphones, but instead both have an Apple Watch SE w/ Cellular for basic...

2026 Tax Brackets and Deductions

Key Takeaways The 2026 tax brackets were increased for inflation, allowing taxpayers to earn more income before moving into higher...

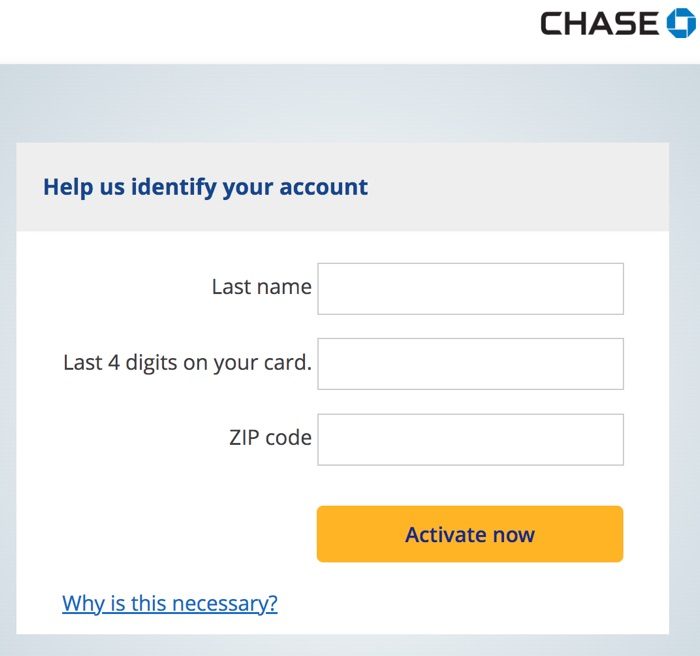

Targeted 5X Points on Gas/Groceries/Restaurants — My Money Blog

New quarter, new offers. A quick 2026 Q1 reminder that you can discover targeted offers for your Chase-issued credit card...

Can I File Taxes If My Parents Claim Me?

Key Takeaways Yes, you can file taxes even if your parents claim you. Dependency status does not prevent you from...

Bank Accounts, Treasury Bills, Money Markets, ETFs – January 2026 — My Money Blog

Here’s my monthly survey of the best interest rates on cash as of January 2026, roughly sorted from shortest to...

Which Is Right for Your Business?

Sales tax compliance has become increasingly complex since the South Dakota v. Wayfair decision. With 46 states and Washington, D.C....

How to Handle Taxes During a Legal Name Change

Key Takeaways A legal name change does not affect how much tax you owe, but it can affect whether the...

MMB Portfolio Asset Allocation & Performance – 2025 Year End Update — My Money Blog

Here is my 2025 Year-End portfolio update that includes all our combined 401k/403b/IRAs and taxable brokerage accounts but excludes our...

Sales Tax Year in Review, Compliance Strategies for 2026

Hard to believe the year is almost over – and it’s also hard to believe just how much change sales tax can stuff into just 12 months. But change did occur, and it’s up to you...