Taxes

How to Report Rental Income and Avoid IRS Red Flags

Key Takeaways: All rental income must be reported—including monthly rent, advance payments, lease termination fees, utility overcharges, and amenity...

Pitfalls of sales tax compliance: billing systems

Sales tax is not top of mind for most executives, but it is something most businesses have to manage at...

When Does the IRS Pursue Criminal Charges?

Key Takeaways: Most IRS interactions are civil, but willful violations of tax law—such as fraud, evasion, or false returns—can lead...

Clothing taxation – and major exemptions

Sales tax rules on clothing are some of the most complex nationwide, as a patchwork of states offer complete exemptions,...

State Tax Liens vs. IRS Tax Liens: What’s the Difference?

Key Takeaways: State tax liens vary widely in how they’re enforced and resolved, while IRS tax liens apply nationwide and...

Defining Your Tech Solution for Tax, Regulatory Compliance

Technology’s bull rush to keep up with consumers’ demand can mean products and offerings cross lines in taxation and regulation....

The Tax Consequences of Winning the Lottery or a Big Prize

Winning the lottery or a big prize can be lifechanging, whether it’s a multimillion-dollar jackpot, a luxury car, or a...

What’s new in sales tax?

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent...

The IRS Identity Protection PIN: Should You Get One?

Tax season can be stressful enough on its own, but for many, it comes with an added worry: identity theft....

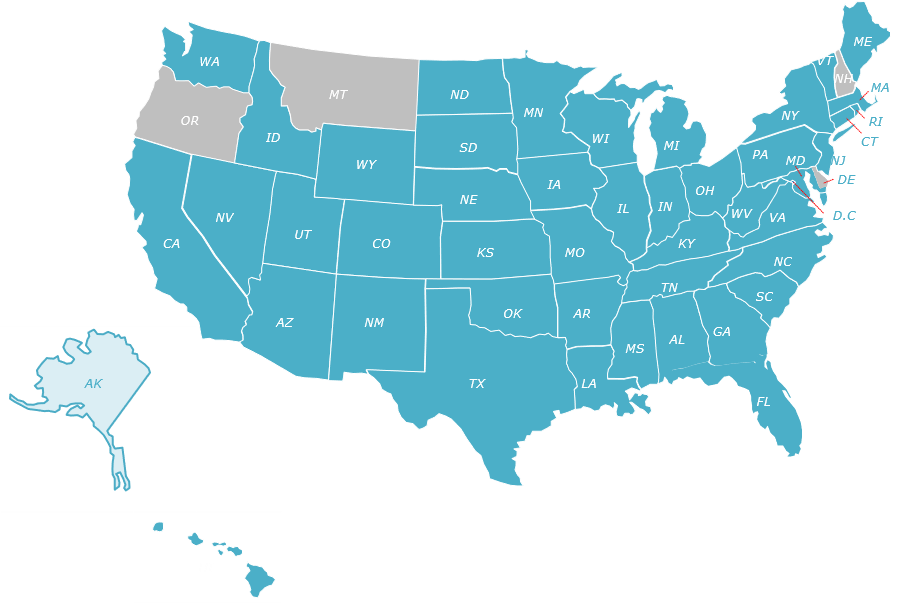

Economic nexus thresholds explained: State-by-state insights

State-by-state economic nexus is one of the biggest considerations for remote sellers – and made even thornier because states’ threshold rules...

Zelle and Taxes: Does Zelle Report to the IRS?

Understanding how Zelle affects your taxes is crucial. This is especially true if you’re using the platform to receive payments...

SaaS taxability: A comprehensive guide

How do states look at SaaS (software as a service)-oriented businesses and sales tax requirements? The short answer is, “Many...