Taxes

The Pros and Cons of Filing Taxes Early vs. Waiting

As tax season approaches each year, one of the most common decisions taxpayers face is whether to file their taxes...

What’s new in sales and use tax?

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent...

What is Imputed Income? | Optima Tax Relief

While you may not have heard of the term “imputed income,” chances are that you might be receiving it from...

Top Reasons Businesses Are Changing Their Sales Tax Processes in 2025

The sales tax landscape is constantly evolving, and businesses must adapt to keep pace. But tax laws aren't the only...

IRS Announces Interest Rates for Q2 of 2025

The IRS has announced that interest rates for the second quarter of 2025 will remain unchanged from the first quarter....

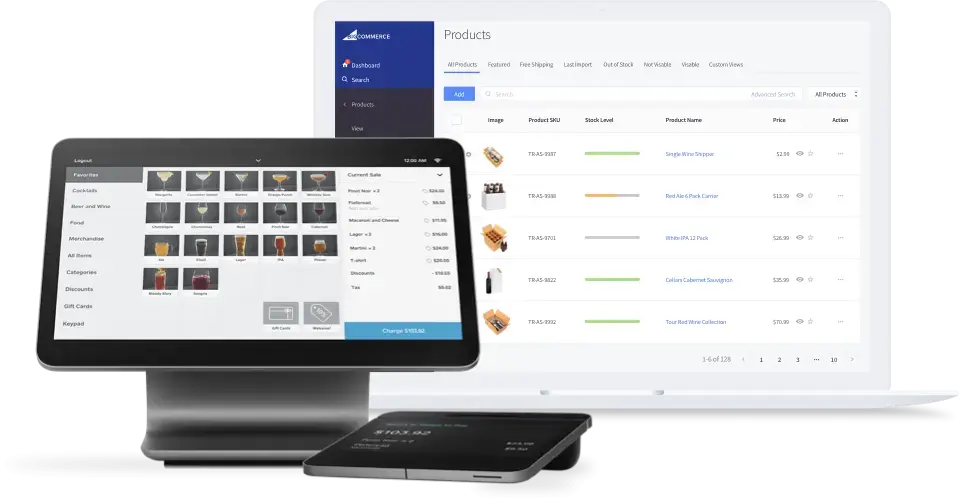

How to Add & Report for Compliance

Does Square pay or submit sales tax for you? Though it has tools to help set up sales tax charges,...

What is Form 1098-T? – Optima Tax Relief

Form 1098-T is an important tax document for students and parents navigating education-related tax benefits. Issued by eligible educational institutions,...

Digging into the sales tax differences

You’d think that if you eat it, its sales tax treatment would be the same – at least similar across...

Do Tax Advocates Really Help?

Dealing with the IRS can be overwhelming, especially for taxpayers facing financial hardship. Tax advocates play a crucial role in...

What’s new in sales tax?

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent...

What is the IRS? | Optima Tax Relief

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing tax laws in the United States....

Etsy Sales Tax Explained: A Guide to Form 1099-K, Exemptions, & Filing

Your sales tax obligations are almost always complex, but tax compliance can get even more complicated when you use a...