Taxes

Who is Best to Help with Back Taxes?

Struggling with back taxes can feel overwhelming, but the right professional help can make all the difference. Whether you owe...

TaxConnex Announces Two New Product Lines Along with a Redesigned Website and New Messaging

TaxConnex is paving the way for a new category of sales tax management services – UPSOURCING. Building on our strong...

What is IRS Penalty Abatement?

The IRS imposes penalties on taxpayers for various reasons, including failing to file a tax return on time, failing to...

New year, new sales tax obligations

The excitement of year’s end can push all kinds of taxes to the back of your mind. But it’s a...

Penalties for Unfiled Tax Returns & How to Avoid Them

When you fail to file your tax returns or pay your taxes on time, you may face significant penalties from...

What’s new in sales tax?

There’s always something changing in the world of tax, especially sales tax. Here’s a review of some of the recent...

What is the IRS Fresh Start Program?

A new year could mean a financial fresh start. The IRS Fresh Start program was created to help struggling taxpayers...

Sales Tax Refund Rules | Do You Get Tax Back on Returns?

It seems like a simple part of selling online. You sell an item to a customer, they decide for whatever...

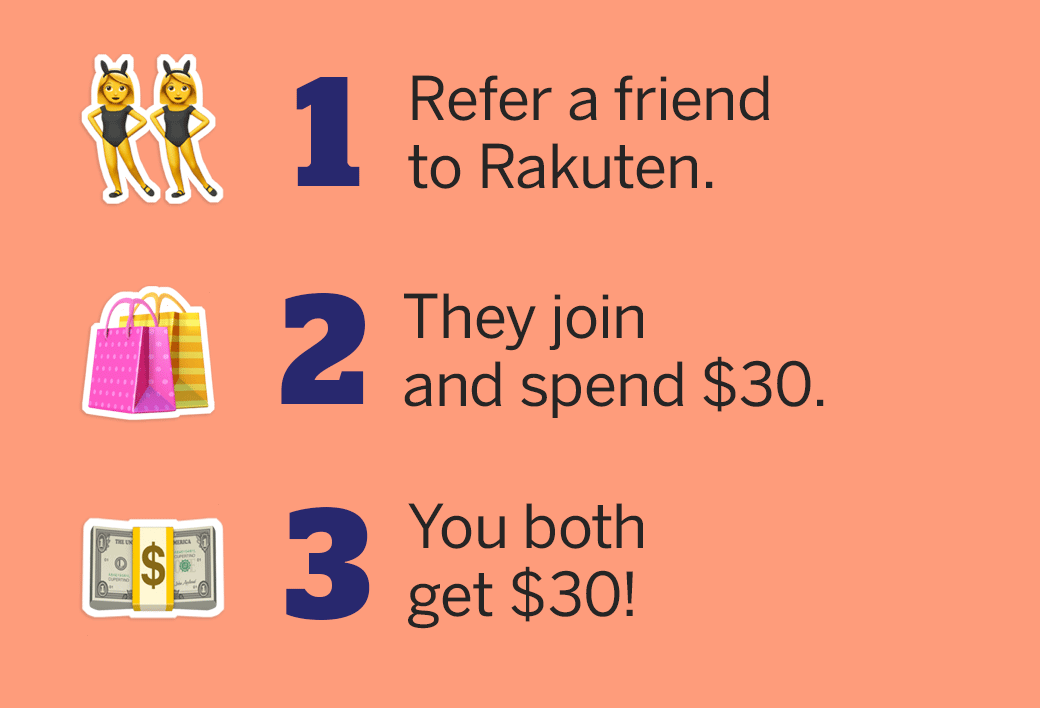

*HOT* Spend $40, Get $40 + Get 25% cash back from PetSmart

Shared on November 19, 2024 This post may contain affiliate links which means I make a small commission if you...

IRS Announces Interest Rates for Q1 of 2025

The IRS has released its updated interest rates for the first quarter of 2025, bringing important changes that will impact...

Marketplace facilitators, holiday sales and tricky nexus

Holiday shopping season offers probably the year’s best chance for your online business to score big, not only through sales...

HOT Disney+ with Hulu for just $2.99 per month for ONE YEAR

Shared on November 29, 2024 This post may contain affiliate links which means I make a small commission if you...