Back on July 10, I told my Next Wave Crypto Fortunes readers that Ethereum was setting up for a big breakout.

At the time, bitcoin was treading water just under $112,000, while Ethereum was inching higher and continuing to outperform bitcoin.

I predicted the main reason this was happening was the coming “stablecoin mania.”

Here’s what I wrote:

The market for stablecoins is projected to grow from around $225 billion today to as much as $6 trillion in the next five years. And the two main blockchains that will benefit from this explosion are Ethereum and Solana. This is the key catalyst that I believe will kick off the next altcoin season.

That was just four weeks ago.

This morning, ETH was trading above $4,600… its highest level in four years.

Source: coingecko.com

And the forces driving it are much greater than short-term hype.

They’re the same forces that have turned gold into a $15 trillion global reserve asset.

And they’re laying the groundwork for something that could push Ethereum and certain altcoins into uncharted territory.

From Risky Asset to Reserve Asset

For most of its decade-long history, Ethereum was considered a high-volatility trade. Investors bought it when they felt confident and then sold it at the first sign of trouble.

But that’s no longer the case.

Analysts tracking blockchain-ledger activity say the total Ethereum held by corporate treasuries, investment firms, ETFs and other institutional entities now sits between 2.7 and 3 million tokens.

That equates to around $12 billion.

In a clear indicator of this trend, SharpLink Gaming, Inc. (Nasdaq: SBET), now holds more Ethereum than the Ethereum Foundation itself.

The company recently announced its ETH Holdings are expected to exceed $3 billion.

One unidentified institution recently acquired nearly $1 billion worth of ETH in a single week.

And a recent Securities and Exchange Commission (SEC) filing indicates investor Tom Lee’s BitMine Immersion Technology plans to raise $20 billion through stock sales to buy more ETH.

To me, this isn’t the behavior of traders chasing a short-term rally.

Instead, it’s like what you see when central banks add gold to their vaults to back their currencies.

Gold works because it’s trusted and scarce, and it can be exchanged anywhere.

Ethereum is starting to play that role in the digital world.

You see, stablecoins need a secure, dependable network to move money across the globe.

And the Ethereum blockchain is that network. That means, when you own ETH, it’s like owning a piece of the infrastructure that stablecoins run on.

But the supply of ETH is also limited. So if the stablecoin market grows into the trillions, as many predict it will, then the demand for ETH to power those transactions is only going to increase.

That’s why institutions are locking in their positions now.

Ethereum (ETH) Holdings Trend Among Institutional Investors

Source: Strategic ETH Reserve

But this Ethereum rally isn’t just about who’s buying.

It’s also about how they’re buying.

When the SEC approved Ethereum ETFs in May of last year, pension funds, mutual funds and other big investors suddenly became able to buy ETH through a brokerage account, just like they’d buy shares of stocks.

Before that, anyone who wanted to own ETH directly had to set up a crypto wallet and manage “private keys,” the digital passwords that control funds held in the wallet.

Most large institutions didn’t want the risk or hassle of holding those keys themselves. But ETF shares gave them an easy workaround.

Then just a few weeks ago, the SEC made another rule change that could be just as important.

On July 29, it approved something called in-kind creation and redemption.

In layman’s terms, this means ETF managers can now accept ETH when building new shares of a fund, instead of having to convert everything into cash first.

This both speeds up transactions and lowers the trading costs for big investors. It also makes it easier to move large amounts of ETH in and out of the fund without pushing the market price around.

It’s like upgrading from a two-lane road to a six-lane highway so everyone gets to where they’re going faster.

And that’s exactly what has happened to the Ethereum market.

On July 23, Ethereum ETFs pulled in $332 million, marking the 14th day in a row of positive inflows.

Source: Sosovalue

Cryptocurrency ETFs ended up having their best month ever in July, with $12.2 billion in inflows.

Now, regulators are considering whether Ethereum ETFs can include staking.

Staking is a process where ETH holders earn payouts for helping secure the network. If it’s approved, it would let these funds share Ethereum’s built-in yield with their investors.

In other words, it would turn ETH from something you only profit from if the price rises into an asset that can also generate income.

And all this is happening as the Trump administration rapidly works to overhaul how crypto fits into the U.S. financial system.

On August 7, President Trump signed an executive order directing the Department of Labor to update rules so that 401(k) retirement plans can include crypto.

This could be huge for ETH because the U.S. retirement market is absolutely massive…

Between $12 and $43 trillion, depending on how it’s measured.

Which means even a small allocation toward Ethereum through ETFs could send ETH soaring.

Paired with a potential Strategic Digital Asset Reserve, this move could also position crypto as a store of value on par with oil or gold.

Here’s My Take

Unlike what’s happening in the stock market right now, Ethereum’s rally isn’t being fueled by a burst of retail speculation.

It’s the start of a structural shift in how this asset is viewed and used.

Institutions are treating Ethereum as if it were a reserve asset like gold. ETFs are making it easier and cheaper to gain exposure, and regulators are clearing the way for trillions in potential new investment through retirement accounts and government reserves.

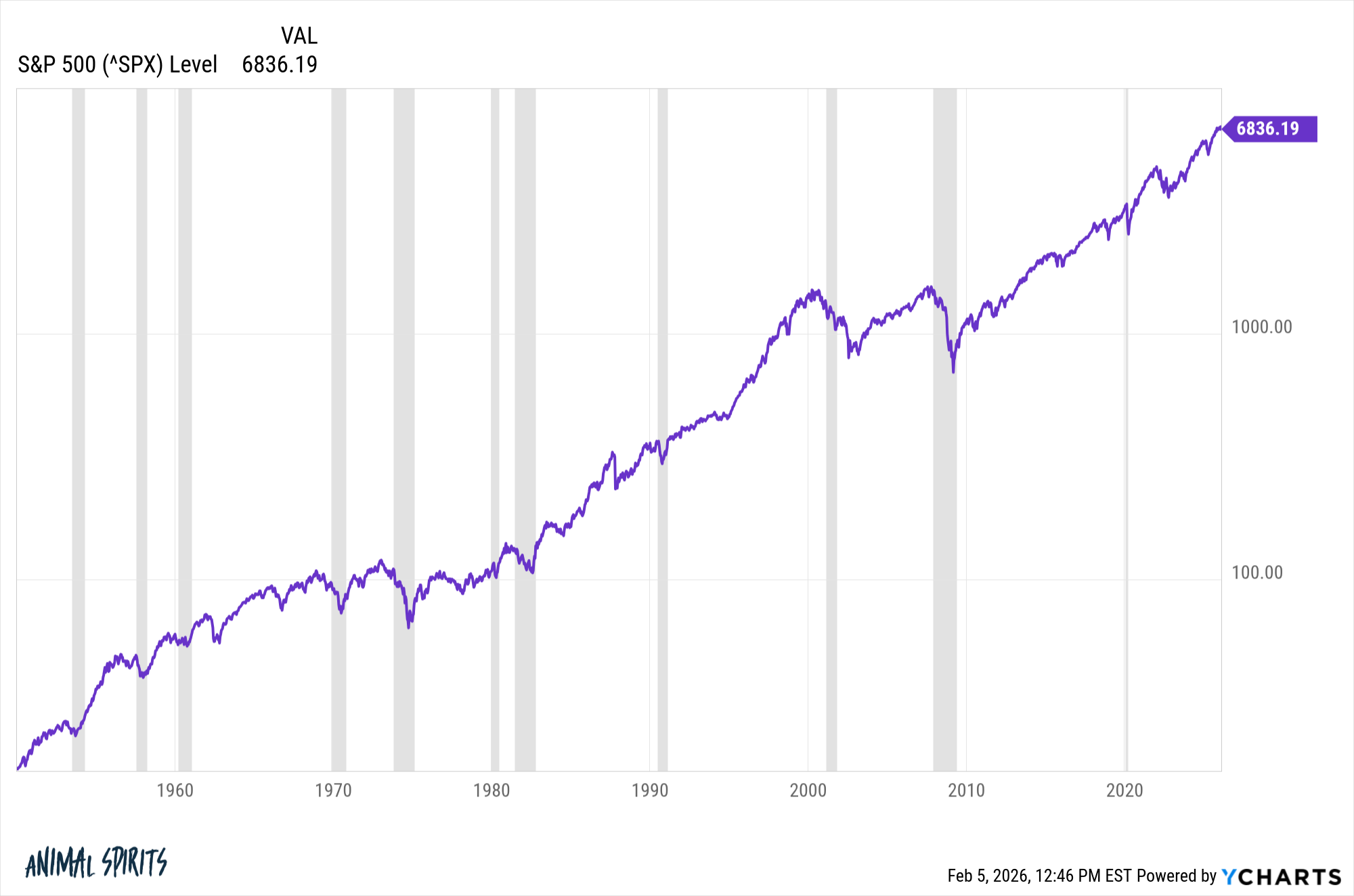

We’ve seen something similar play out before.

When gold was cut loose from the dollar in the early 1970s, it went from being a fixed commodity to a free-traded asset.

That single policy change redefined gold’s place in the global economy and triggered a permanent shift in how the market valued it.

And in less than a decade, the price of gold shot up by more than 500%.

If Ethereum is entering its own “gold moment,” then we’re still in the very early stages.

I’m already on record that ETH will hit $10,000.

So the real question now isn’t whether ETH will set a new high…

It’s which altcoins will follow as institutions look for the next piece of essential digital infrastructure to add to their reserve?

I’ve identified five tiny cryptos that could absolutely skyrocket in the weeks and months ahead…

And I recently went LIVE to discuss them with my publisher.

But here’s the thing…

Despite massive demand, we’ve already pulled down that video.

But I’m making it available for my Daily Disruptor readers ONLY right now.

Because Ethereum could break $5,000 any day now, and you don’t want to get left behind.

To find out how you could profit from the $12.2 trillion floodgate that President Trump just opened…

Before it’s too late.

Regards,

Ian King

Chief Strategist, Banyan Hill Publishing

Editor’s Note: We’d love to hear from you!

If you want to share your thoughts or suggestions about the Daily Disruptor, or if there are any specific topics you’d like us to cover, just send an email to [email protected].

Don’t worry, we won’t reveal your full name in the event we publish a response.

So feel free to comment away!

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link