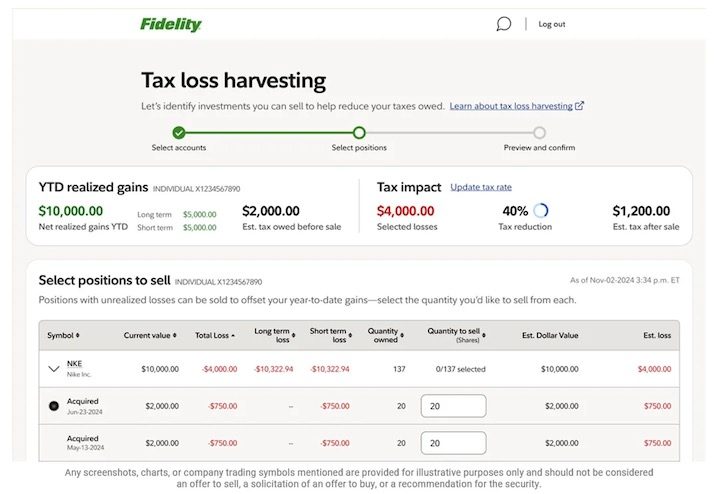

Fidelity has a number of useful Tools & Calculators, most of which are open to everyone to use. However, their Tax-Loss Harvesting Tool (login required) is meant for Fidelity taxable brokerage customers, as it is based on your personal data and shows the size of your expected capital gains this year, while also helping you identify capital losses that you can “harvest” if you wanted.

You’ll need to provide your marginal tax rates (make an estimate with current brackets here). The tool can even help you place the (market) order to sell those shares with just a couple clicks.

This Fidelity article How to reduce investment taxes contains a lot of details on the practice of tax-loss harvesting:

An investment loss can be used for 2 different things:

– The losses can be used to offset investment gains.

– Remaining losses can offset $3,000 of income on a tax return in one year. (For married individuals filing separately, the deduction is $1,500.)

[…] There are 2 types of gains and losses: short-term and long-term.

– Short-term capital gains and losses are those realized from the sale of investments that you have owned for one year or less.

– Long-term capital gains and losses are realized after selling investments held longer than one year.

The key difference between short- and long-term gains is the rate at which they are taxed.

Short-term capital gains are taxed at your marginal tax rate as ordinary income. The top marginal federal tax rate on ordinary income is 37%.

Wash sale warning: The tool can’t cross-reference all your other non-Fidelity trades, and also doesn’t even account for your Fidelity trades within tax-deferred accounts.

If a wash sale occurs, your loss will be disallowed. Here’s the warning provided:

Wash sale warning: Estimated savings based on tax-loss harvesting assumes that you will not have a wash sale that would defer your tax loss.

If you sell shares at a loss and you purchase additional shares of the same or a substantially identical security (in the same or a different account) within the 61-day period that begins 30 days before and ends 30 days after the trade date of the sale, the purchase may result in a wash sale. If a wash sale occurs, the loss from the transaction will be “disallowed” for tax purposes, and the amount of the loss will be added to the cost basis of your shares in the same security. Fidelity adjusts cost basis information related to shares in the same security when a wash sale occurs within an account as the result of an identical security purchase.

You must check your own records across all of your Fidelity and non-Fidelity accounts to ensure that you are correctly accounting for losses related to any wash sales.

ETFs are often the easiest way to harvest a tax loss. Even if you buy-and-hold ETFs, consider ETF tax-loss harvesting (my post from 2008?!) as you can harvest the loss from the sale of an ETF, and then immediately buy a similar but not “substantially identical” ETF without triggering a wash sale.

This has become common industry practice. There’s a Fidelity article on this too.

When evaluating your ETFs against the wash-sale rule, compare the issuer, index, and underlying holdings between the two ETFs being swapped. The more dissimilar these are, the more likely it is that you won’t trigger a wash sale.

Even Vanguard does ETF tax-loss harvesting in their advisory services using “surrogate ETFs”.

Surrogate funds are the ETFs (exchange?traded funds) Vanguard Personal Advisor uses toreplace investments sold to harvest losses. They are Vanguard ETFs® with similar asset and sub?asset allocations to the funds we’re replacing.

There may not be as many opportunities to harvest a tax loss this year since most things are up (a good thing!), but something to keep in mind down the road.

The usual disclaimer: I do not provide legal or tax advice.

The information herein is general and educational in nature and should not be considered legal or tax advice.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link