A reader asks:

You said you think AI is some sort of bubble. Bubbles eventually pop. What can investors do if they agree with you and want to prepare for that pop? Or is there nothing you can do but ride the wave?

Even if a bubble is obvious, what do you do about it?

Jeremy Grantham from GMO is an expert on financial bubbles.

Here’s something he wrote about the current cycle:

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle. For positioning a portfolio to avoid the worst pain of a major bubble breaking is likely the most difficult part. Every career incentive in the industry and every fault of individual human psychology will work toward sucking investors in.

But this bubble will burst in due time, no matter how hard the Fed tries to support it, with consequent damaging effects on the economy and on portfolios.

Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives. Speaking as an old student and historian of markets, it is intellectually exciting and terrifying at the same time. It is a privilege to ride through a market like this one more time.

Investing in most market environments is equally exciting and terrifying. But the way Grantham describes the current market set-up does sound scary.

Here’s the problem — Grantham wrote this in January of 2021. Despite a bear market in 2022 and the Liberation Day kerfuffle earlier this year, the S&P 500 is up 90% since he wrote this.

The Nasdaq 100 has doubled.

That’s returns of around 15% per year.

These things are not easy to forecast even if it feels like the sequel to a movie we’ve all seen before.

All that meme-stock and SPAC craziness in 2021 did feel like a mini-mania but no bubble burst. I don’t want to put words in his mouth, but Grantham would probably say we’ve simply created an even bigger bubble with the AI spending binge.

The immense amount of spending on the AI buildout certainly feels like some of history’s prior innovation investment bubbles. The problem is everyone knows when we’re in a crisis but no one ever really knows when we’re in a bubble.

No one can say for sure but for argument’s sake, let’s say this is a bubble. What should you do as an investor who gets caught up in the midst of a speculative mania?

The way I see it, you have four options when investing in a bubble:

1. You could go all-in. George Soros once said, “When I see a bubble forming, I rush to buy, adding fuel to the fire.”

You could try to be Soros and ride the wave.

Who knows how far this AI stuff could go?

Maybe Nvidia becomes the first $10 trillion company? Oracle might hit the quad comma club and become the next trillion dollar corporation. Mark Zuckerberg could get AI to steal all of our Social Security numbers before all is said and done.

Who knows how long this will last? Maybe going all-in on AI-related stocks will continue to pay off.

However, this is the type of strategy that works gloriously until it doesn’t.

You need an exit strategy if you’re trying to be the next Soros.

2.

You could hedge. If you’re really nervous you could go to cash or buy bonds or buy puts or invest in some sort of hedged strategy.

The problem with this strategy is that market timing is always hard, but even more so in a bubble-like situation. There is no science behind how far the pendulum will swing from one extreme to the next.

What if you miss a melt-up?

Am you comfortable dealing with FOMO?

How will you know if you’re wrong?

Going all-in or all-out is extremely difficult not just because timing markets is hard but because it always weighs on your psyche.

3. You can diversify. Even if you’re 100% certain we’re in a bubble, you don’t have to go all-or-nothing.

You could just diversify your portfolio away from the Mag 7 hyperscalers.

Coming out of the dot-com bust there were other areas of the market that did just fine despite tech stocks getting slaughtered. Look at how well small cap value and bonds did during the dot-com bust:

The Nasdaq 100 got shellacked after the insane tech run of the late-1990s.

But small caps and value stocks didn’t keep pace during that run-up — just like the current cycle — and they outperformed in a big way once the bubble popped.

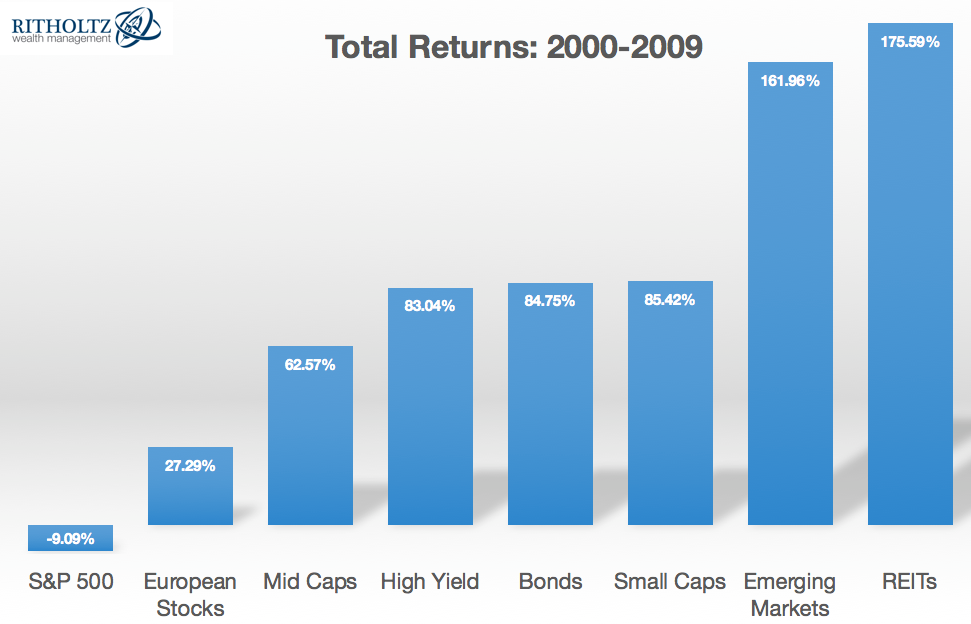

The performance of other asset classes during the lost decade for the S&P 500 in the 2000s is a poster child for diversification:

I’m not suggesting this cycle is going to play out just like the dot-com bubble did but there are plenty of asset classes, strategies and geographies that aren’t nearly as highly valued as the giant tech stocks.

Diversification can be difficult when returns are concentrated, but it’s a great way to protect yourself when that concentration rears its ugly head to the downside.

4. You can do nothing. Doing nothing is a choice too. As long as you have an investment plan in place that suits your risk profile and time horizon the best move here might be to just follow your plan.

Stay the course, come what may.

You just have to be sure you have an asset allocation and investment strategy you can stick with come hell or high water. You need to be comfortable sitting through drawdowns and volatility and avoiding FOMO because you’re not changing your portfolio all the time like some investors.

Doing nothing is a simple strategy but it’s not easy by any means.

I’m doing nothing with my portfolio.

I’m not making any changes. I’m staying diversified, rebalancing on occasion and continuing to make contributions into my various accounts.

Whether it’s a bubble or something else I know that having an equity-heavy portfolio occasionally means being uncomfortable and seeing a portion of my portfolio get vaporized. To me the long-term returns are worth that risk.

You really just have to weigh the trade-offs and perform a little regret minimization to determine which route you’ll regret less:

- Potentially missing out on further gains?

- Potentially taking part in big losses?

Obviously, life would be easier if you could just ride the AI wave higher and step off right when it’s about to crest but that’s not a realistic strategy.

Experience has taught me nobody has the ability to predict the turns in these cycles consistently.

So I’m not going to try.

I covered this question on the latest episode of Ask the Compound:

[embed]https://www.youtube.com/watch?v=R94OzOmDr3w[/embed]

We also discussed questions about utilizing home equity in retirement planning, how to balance spending vs. saving, when it makes sense to pay for a financial advisor, and what constitutes upper middle class in America.

Further Reading:

The Weirdest Bubble Ever

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link