A reader asks:

Ben shared a chart in a recent episode that shows nationwide housing prices rarely ever fall in the U.S. That makes me feel a little better about my wife and I (both 29) buying our first home. But isn’t today a terrible time to buy a home from an investment perspective because prices are so much higher? What should we be considering when looking at this through an investment lens (knowing full well there are other reasons to buy a house)?

The conundrum posed in this question looks something like this:

Housing affordability is not good because we pulled forward a decade’s worth of gains into a 3 year window.

However, housing prices have rarely gone down historically.

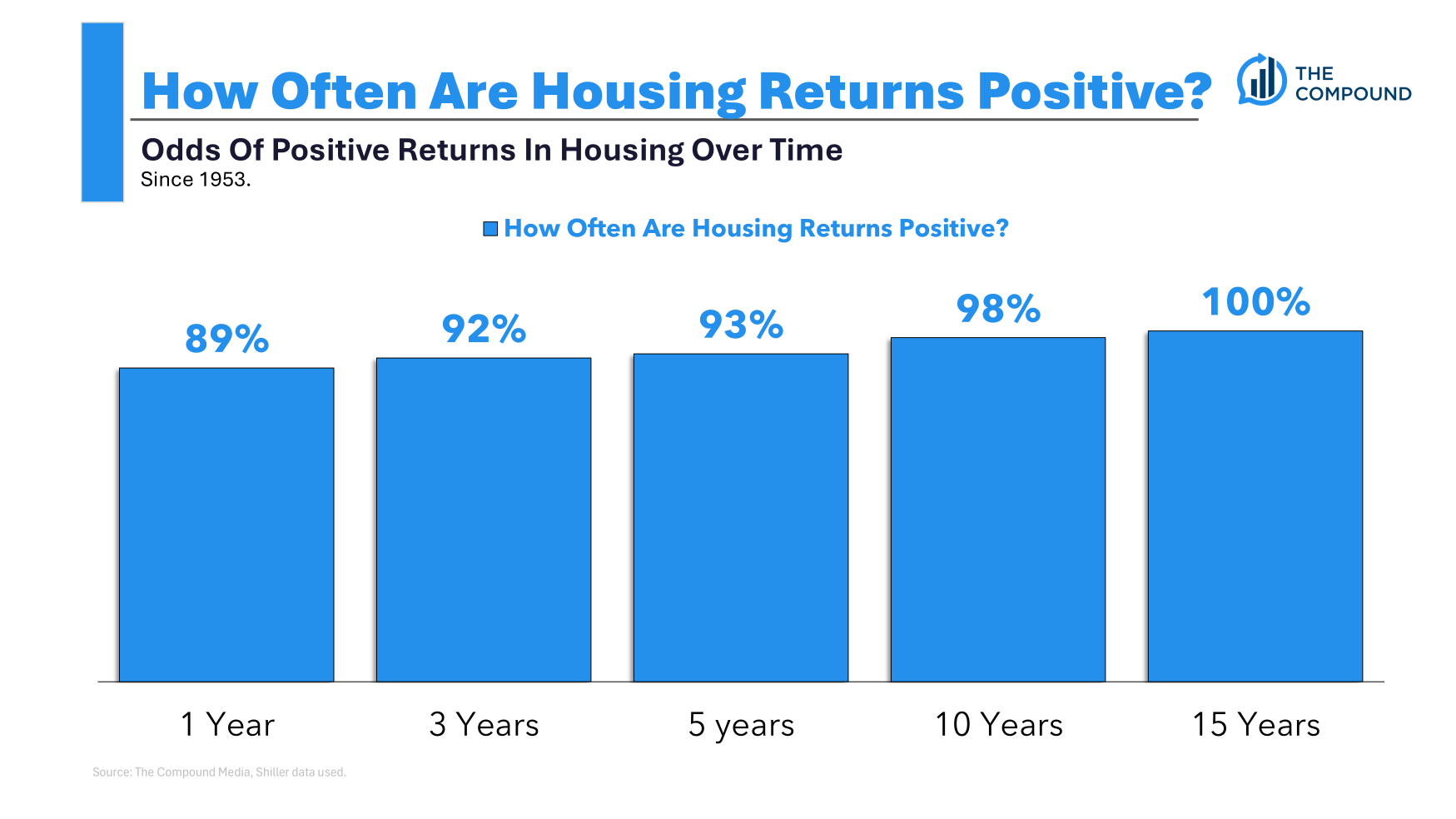

Here’s the chart mentioned (from this blog post):

Housing prices simply don’t fall that often on a nationwide basis.

The real question here is how do we square the current data with the historical data? Should you listen to the present or the past?

As always, the most important distinction with every investment is the time horizon. How long do you plan to own the house for?

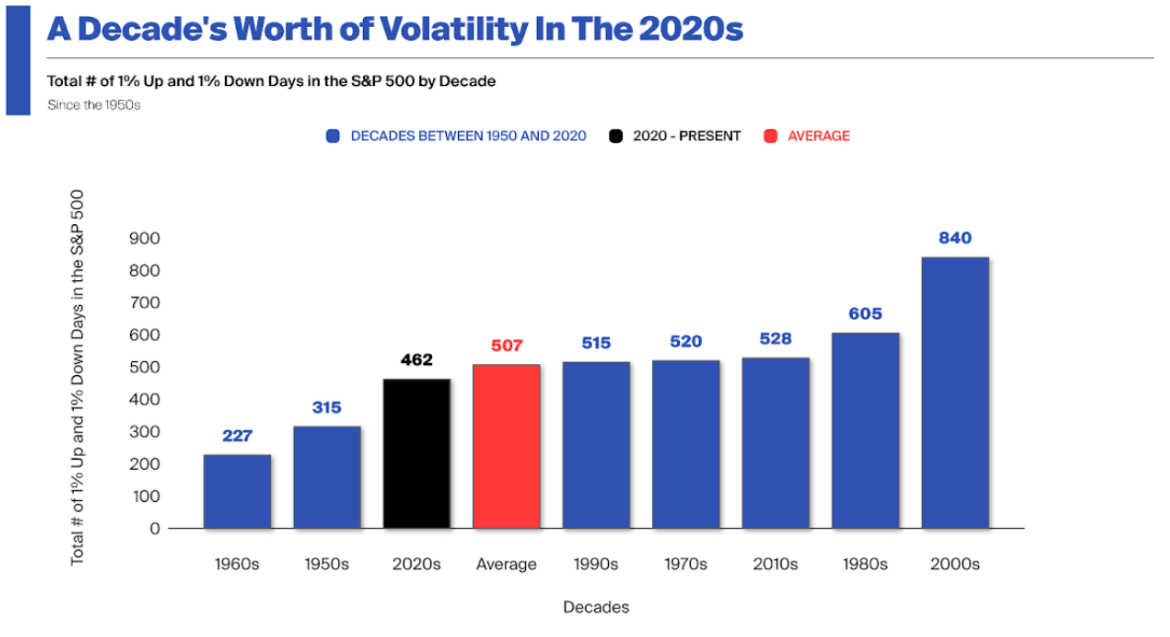

One of my favorite charts looks at the win rate for the stock market by holding period:

The stock market is the best casino on the planet. The longer you play, the higher your odds of walking away a winner, the opposite of an actual casino.

I had never looked at this data before regarding housing.

Here’s what it looks like going back to the 1950s:

Pretty impressive. That’s a much higher win rate than the stock market across the board.

Of course, your expected returns are lower in the housing market and there isn’t as much volatility so these results make sense in theory as well as practice.

It’s also worth noting that these numbers don’t include all of the ancillary costs like realtor fees, property taxes, closing costs, insurance, maintenance, etc.

But those frictional costs are why your time horizon is even more important in the housing market than the stock market. You don’t want to be jumping in and out of real estate deals because the costs will eat up the bulk of your gains.

I don’t know what’s going to happen with housing prices from here.

It wouldn’t surprise me if they stagnate for a few years while incomes play catch-up to even our affordability. Or maybe they will simply keep up with inflation.

Who knows? Maybe inflation and/or demographics push housing prices even higher.

The 2020s are a perfect example of how unknowable housing price returns can be. No one could have possibly predicted a housing boom because of a pandemic.

In lieu of a crystal ball, here are some considerations if you’re worried about the investment side of things when buying a house in the current environment:

You could use a smaller down payment. If you’re worried about housing as an investment, you might put down 5-10% instead of 15-20%.1

This would involve borrowing more money but it’s less up front in an asset that you think might struggle in the years ahead. That way you could keep money in other risk assets as well.

Leverage cuts both ways but my first down payment was just 5% and I was fine with that.2

You could skip the starter home. I’ve never been a huge fan of starter homes because of all the costs involved in real estate transactions.

I don’t like the idea of buying a house, maybe putting some money into it and then hoping to sell it 3-5 years in the future in order to trade up.

Most of your equity gets eaten up by realtor fees, closing costs and the heavy up-front interest expense on your mortgage.

If you can afford it, I prefer paying up for a better home you can see yourself living in for a much longer time frame.

You could live in the house longer. The best investment advice often boils down to lengthening your time horizon. Could housing be a bad investment for the next few years? Yeah it could.

If you plan on living in the house for 10+ years I don’t think you’ll regret it.

The most important thing is your ability to service the mortgage debt and handle all the ancillary costs of homeownership.

If you can do that while living in your desired neighborhood and derive some psychological benefits then it’s worth it.

If you can’t stomach the possibility of potentially living in a bad investment, homeownership might not be for you.

I covered this question on an all-new episode of Ask the Compound:

[embed]https://www.youtube.com/watch?v=ZU1PmeEEAoU[/embed]

My favorite CFO, Bill Sweet, joined us on the show again this week to answer questions about Roth 401ks, using margin in your portfolio, balancing retirement accounts and how a 22-year-old should save for retirement. Plus we asked Bill a bunch of tax questions to prepare for the new year.

Further Reading:

Will Home Prices Finally Fall in 2026?

1Assuming your financial institution allows it.

2It was also all we could afford at the time.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link