I owned a pair of American Eagle jeans once, probably 2004-ish.

They were boot cut, had some of those man-made holes in them, a little distressed. It was a thing. You had to be there.

The stock has languished ever since I last set foot in an American Eagle store in my local mall:

The share price first crossed current levels more than 20 years ago.

Sydney Sweeney is trying to change all of that. The company rolled out a new ad campaign with Sweeney to revive the brand.

The stock shot up 15% in a matter of days after the announcement.

Then yesterday Donald Trump posted about it on social media.

The stock was up another 24%. In a single day!

I guess we can add American Eagle to the list of meme stocks along with GameStop, AMC, Hertz, Opendoor, Kohl’s and GoPro.

Every time a new meme stock drops someone invariably posts this picture on Twitter:

It’s a funny meme.

Fundamentals don’t matter anymore. Value investing is dead. Why even try to understand what’s going on anymore when you have these crazy moves?

I get it.

But I have to stand up for my fellow Ben here.

Benjamin Graham conceived of the idea behind meme stocks in The Intelligent Investor. In chapter 20 of Graham’s famous book he tells the story of Mr.

Market:

Imagine that in some private business you own a small share that cost you $1,000.1 One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them.

Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes seems to you a little short of silly.

If you are a prudent investor, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interesr in the enterprise? Only in case you agree with him, or in case you want to trade with him.

You may be happy to sell out to him when he quotes you a ridiculously high price, and equally happy to buy from him when his price is low. But the rest of the time you will be wiser to form your own ideas of the value of your holdings, based on full reports from the company about its operations and financial position.

Price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market.

The idea here is still the same as when Graham wrote about it more than 75 years ago.

It’s just that now Mr. Market sometimes acts as if he’s had 13 Red Bulls before the market opens each day.

But fundamentals still matter over the long-term, even if there are dislocations in the short-term.

For example, the biggest stocks are the biggest stocks for a reason:

Yes the S&P 500 is concentrated but so is the share of profits produced by these companies in the top 10. The share of earnings from these stocks has also grown along with the share price gains. Valuations are well above average because these are the best corporations in the world.

If competition eats into their profit margins, these stocks will stop outperforming and shrink as a percentage of the market.

Fundamentals still matter.

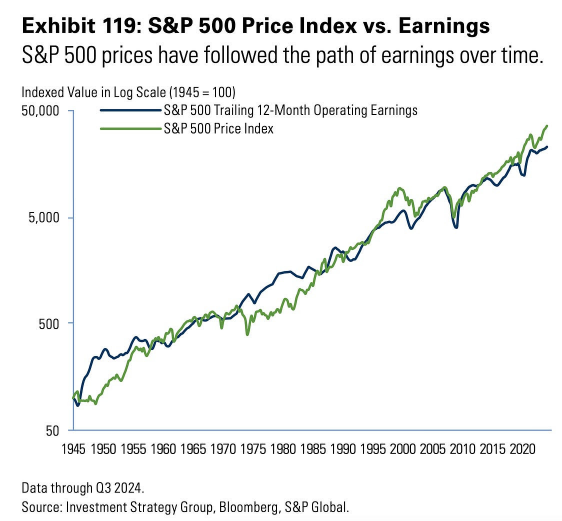

Just look at the stock market compared to earnings since the end of WWII:

There are times when the market gets ahead of the fundamentals (or falls behind) but there is a clear relationship in the data over time.

I’ll admit the meme stock speculation is kind of annoying to a long-term investor like me, but fundamentals catch up to these names as well. Just look at the drawdowns for AMC and GameStop since the height of the last meme stock frenzy:

To butcher another Graham quote, in the short-run Mr. Market is a voting machine but in the long-run he’s a weighing machine.

Further Reading:

Pandemic Babies & a Bull Market in Risk

1$1,000 in 1949, when this book was published, is more like $13k today.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link