Along with stablecoins, tokenization has become a central focus regarding digital assets by the financial services industry. However, a European regulator has raised concerns that the technology could cause misunderstandings for retail stock investors.

According to Reuters, Natasha Cazenave, Executive Director of the European Securities and Markets Authority (ESMA), spotlighted the many fintech companies that are now working to create tokens backed by corporate stocks.

Although there are tangible benefits to this model, the ESMA chief said many investors in these instruments may not understand that they aren’t directly buying a share in a company when they buy a tokenized stock. Instead, tokenized stocks are held by a special-purpose company and backed by the shares they represent.

Market and Regulatory Risks

Cazenave’s comments echoed a recent statement from the World Federation of Exchanges (WFE), a London-based consortium of financial institutions. The WFE addressed a letter to the leading global securities commissions to warn about the risks of tokenized stocks, saying that these representations of mainly U.S. stocks were often listed by unregulated brokers and crypto firms.

The WFE also pointed out risks that this model could pose for stock markets.

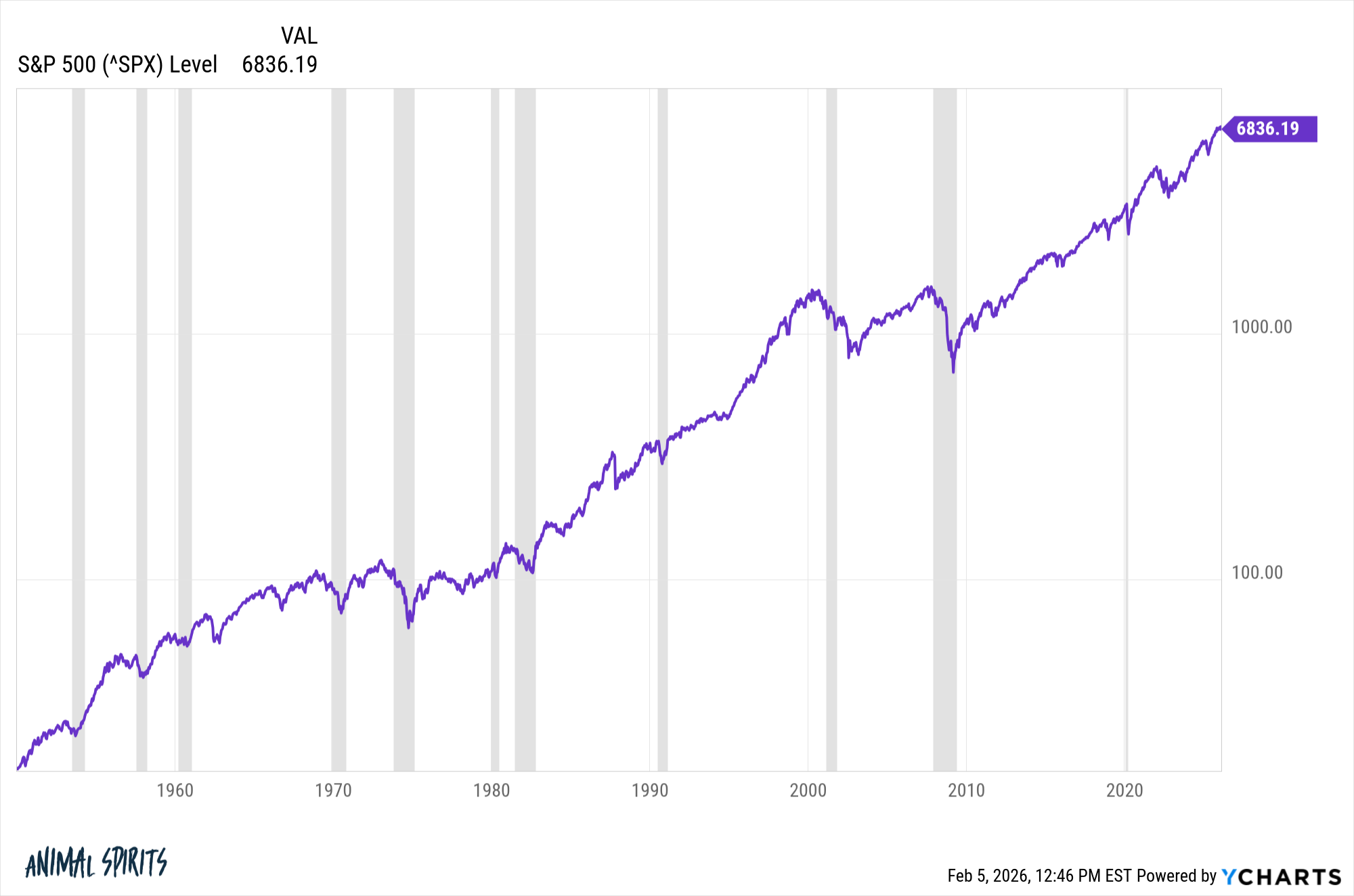

Tokenized stocks traded outside of regulated markets could potentially drain liquidity from traditional exchanges, affect stock prices, and diminish market integrity. Additionally, the WFE said that if a trading platform failed, determining asset ownership could be difficult.

A Proper Regulatory Framework

Although there are concerns about the technology, tokenization has become one of the most powerful forces driving the financial services industry. Tokenization makes trading real-world assets more transparent and efficient, and it goes far beyond stocks—including such things as bank deposits, property deeds, and government bonds.

For this reason, tokenization projects have received heavy investments from many of the world’s largest financial players, including Blackrock, JPMorgan Chase, and Franklin Templeton. Additionally, once-reluctant hedge fund Citadel Securities announced its intentions to enter the crypto market.

Tokenization has also become a central initiative for many nations.

The Bank of England recently noted that the technology would play a key role in the country’s future innovations in financial services.

Despite its concerns about tokenized stocks, ESMA also said that it wasn’t backing away from tokenization technology. The EU has been a leader in the digital assets movement, as evidenced by the region’s newly passed Markets in Crypto-Assets regulations, which govern the disruptive technology.

Cazenave underscored the EU’s role as a financial services innovator and acknowledged that tokenization could lower costs, improve transparency, and make transactions more efficient—so long as it operates within a proper regulatory framework.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link