There’s an old saying that a house is the biggest investment you’ll ever make.

For some people that’s true. For others, there are far more important investments.

It all depends on where you reside on the wealth distribution.

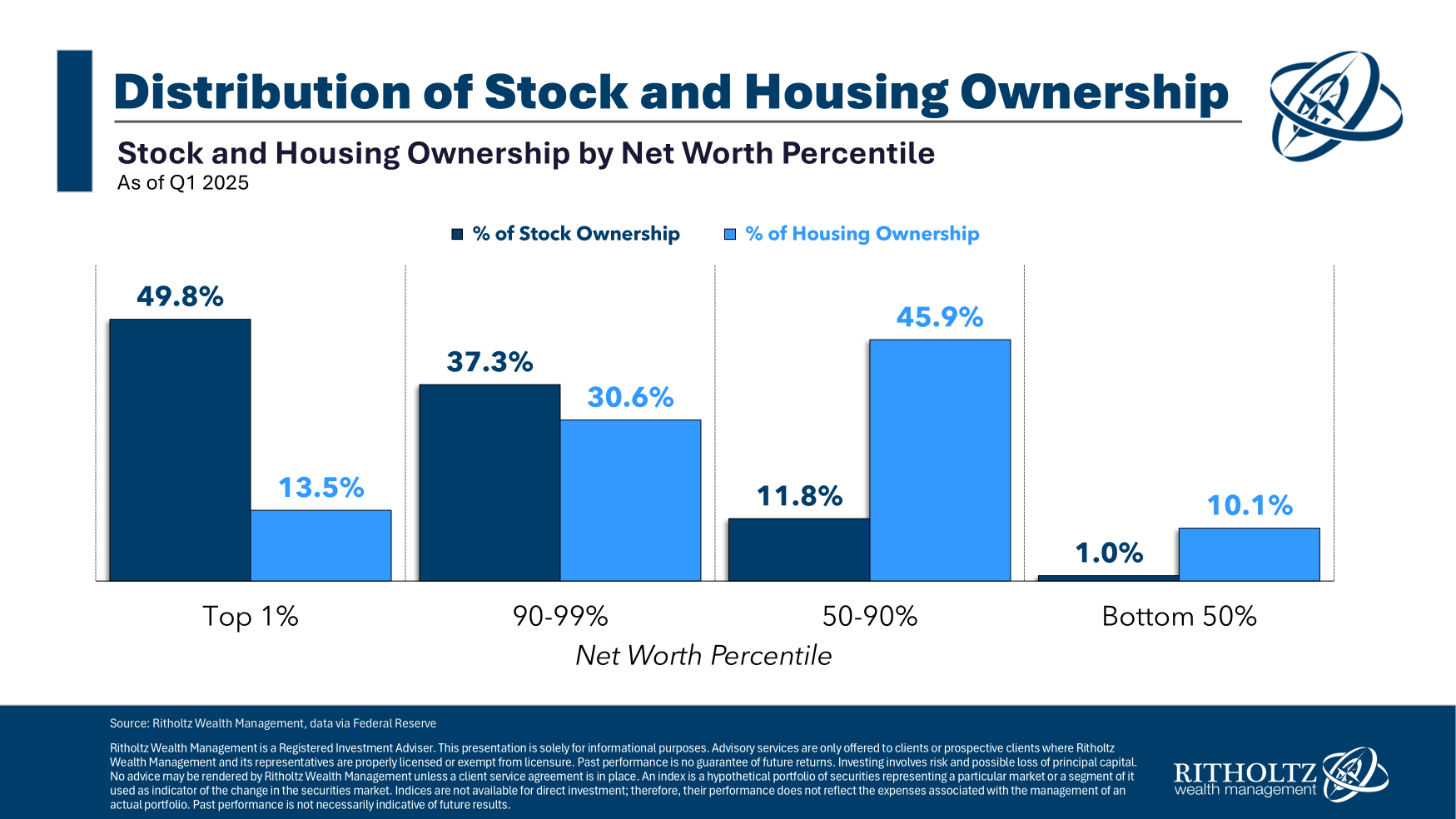

The top 10% owns 87% of the stock market in the United States and 44% of the housing market.

The bottom 90% owns 13% of the stock market and 56% of the housing market.

Real estate is far more important to the middle class than the upper class when it comes to their primary residence. The stock market matters more to the upper class.

But there is one asset that’s much bigger than you think when it comes to most Americans’ household savings — Social Security.

A report from the Congressional Budget Office breaks down household wealth by calculating the net present value of Social Security payments for households. The monthly checks are worth more than you think.

The CBO estimates Social Security accounted for 20% of household wealth in the U.S. by the end of 2022.

Other retirement accounts — 401k, 403b, IRA, pensions, etc. — made up 21% of household wealth. Combined, that’s around $80 trillion of the $199 trillion in total household wealth.

Like housing and the stock market, that wealth is not evenly distributed.

Social Security matters a great deal to people on the lower end of the wealth spectrum.

The CBO broke down average wealth over time by the top 10%, 51-90%, 26-50% and bottom 25% along with how those values would look excluding Social Security:

As you move down the wealth ladder, the gap widens. For the bottom 50%, Social Security accounts for more than 40% of financial assets. For the bottom 25%, it’s nearly half of the household assets.

There are more rich people than ever before right now but there are plenty of people who don’t have nearly enough money saved for retirement.

Social Security will play a pivotal role in retirement planning for millions of Americans in the coming years.

Speaking of rich people, it’s interesting to note that the gains to the upper classes and lower classes of wealth haven’t been as out of whack as one would imagine, given the rampant inequality in this country.

This is a look at the growth in total household wealth by the lower, middle and upper classes since 1989:

Obviously, the top 10% has a much greater share of total wealth than the bottom 90%.

But this surprised me:

Between 1989 and 2022, the total wealth held by families in the top 10 percent of the distribution increased by 306 percent; that of families in the 51st to 90th percentiles increased by 243 percent; and that of families in the bottom half of the distribution increased by 285 percent. In 2022, families in those categories had wealth totaling $119.6 trillion, $66.5 trillion, and $12.8 trillion, respectively.

The percentage gains were far closer than I would have expected.

Here’s the chart version that shows the distribution of wealth over time:

The bottom 50% has been consistent. The biggest change is a shrinking share of wealth in the 51-90% group and a growing share for the top 1%. The remainder of the top 10% has been more or less unchanged.

So basically all of the wealth inequality we’ve experienced has gone to the tip of the spear.

Drilling down even further, according to Fed data, the top 0.1% — the top 1% of the top 1% — now controls 13.8% of the wealth in America, up from 8.6% in 1989.

It’s not that the rich have gotten richer. It’s that the filthy rich have gotten even filthier.

The way I would summarize all of this data looks like this:

- Stocks are the most important financial asset for the upper class.

- Housing is the most important financial asset for the middle class.

- Social Security is the most important financial asset for the lower class.

This isn’t everyone. The homeownership rate is 65%. Nearly two-thirds of American households now own stocks in some form.

However, it’s crucial to recognize that Social Security remains a vital financial asset for a large number of Americans.

I hope we don’t screw it up someday.

Further Reading:

The Middle Class, The Top 10% and the Bottom 50%

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link