I’ve seen all sorts of estimates for the coming wealth transfer from baby boomers to the next generation.

$16 trillion. $84 trillion. $124 trillion.

I guess those numbers rely on a bevy of assumptions which is why they’re all over the map.

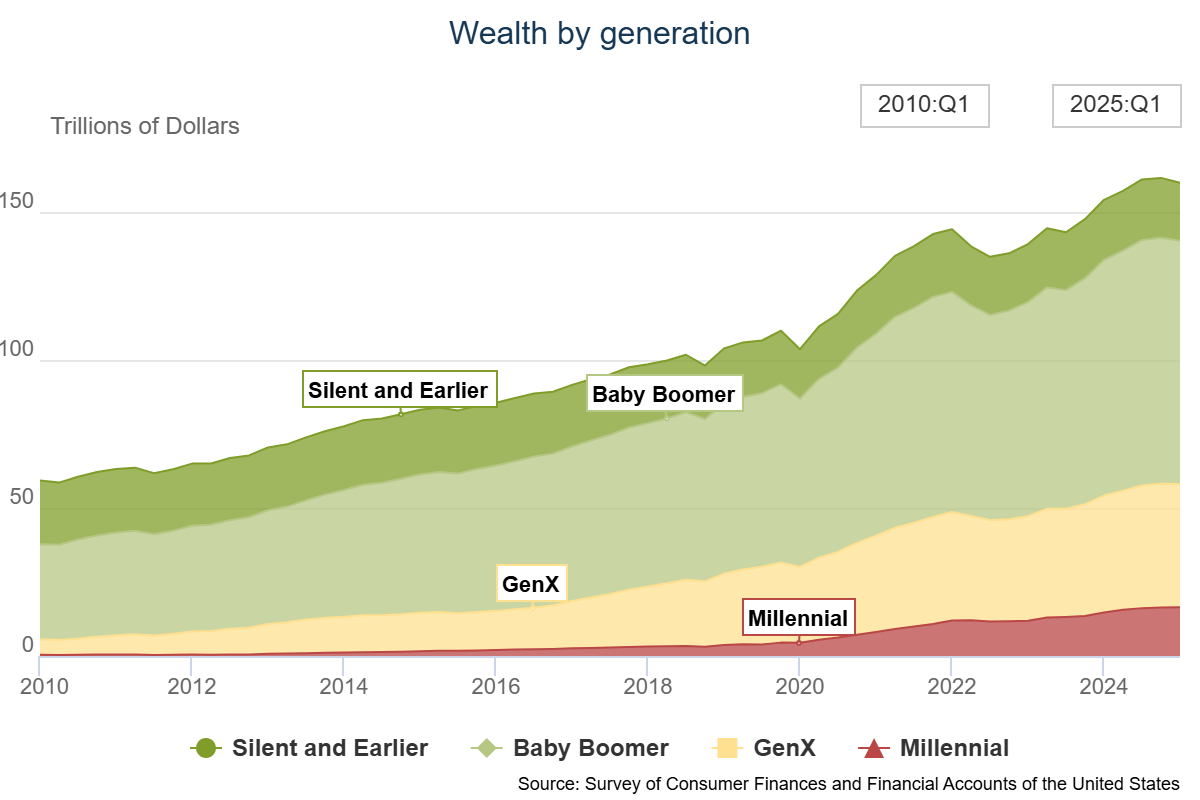

Whatever the actual number is in the future, right now the baby boomer generation is worth more than $82 trillion:

Some of that money will be spent but much of it will be passed down.

There are numerous talking points about The Great Wealth Transfer.

How will it impact the housing market? Will baby boomers give away some of their money to the younger generation now? What does it mean for the stock market? What are the tax implications? How will it shape wealth inequality?

Here’s the one part of this conversation we’re not really touching on — The Great Wealth Transfer requires that the baby boomer generation dies off. Death and taxes, right?

These are people’s parents, grandparents, aunts, uncles and friends.

When that money passes it’s not just a line item on a spreadsheet. There’s an emotional component to it as well.

The money, houses and other items that get passed down will have meaning involved.

In the past month Ozzy Osbourne and Hulk Hogan passed away. They were both in their 70s.

It’s morbid to think about but with 70+ million baby boomers there are going to be a lot of deaths in the years ahead of people you know personally or know of in some other capacity. The median age of baby boomers is around 70 years old.1

I’ve been thinking about death a lot this year after my brother Jon passed away. It forced my family to have lots of difficult and uncomfortable conversations.

A lot of families are going to be forced into similar talks in the years ahead.

Financial advisors often play a role in the money side of the equation when someone dies as well.

There’s a ton of paperwork and decisions that need to be made.

That process becomes far more challenging if things aren’t laid out in advance.

I’ve heard horror stories of financial advisors trying to take advantage of people after a family member passed away. I’ve also seen firsthand how helpful a good financial advisor can be to someone who is dealing with the loss of a loved one by making financial decisions and tasks easier.

That requires having some uncomfortable conversations so everyone’s on the same page.

Carl Richards has always been one of my favorite voices when it comes to simplifying the financial planning process. He’s also a master at getting people to talk about the important stuff.

I wasn’t planning on getting too deep into the topic of death and money but Carl got me to open up.

We talked about how to have uncomfortable conversations with your financial advisor or loved ones too:

[embed]https://www.youtube.com/watch?v=NR8WRV6tCgA[/embed]

We also touched on the biggest worries financial advisors have right now, the shrinking behavior gap, creating authentic content, how to spend your money correctly, Carl’s biggest money mistake and more.

Subscribe here so you never miss an episode.

If you’re an advisor, subscribe to our newsletter at The Unlock where we’re talking about all things wealth management.

Further viewing:

Give your kids the money now!

1The baby boomer generation is typically defined as being born between 1946 and 1964.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner.

You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated.

Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link