At the Berkshire Hathaway shareholder meeting in 1997, Warren Buffett laid out the following scenario:

Imagine you’ve been granted the extraordinary power of determining the economic rules of society 24 hours before being born. Those rules will last many generations.

The one caveat is you don’t know the circumstances you’ll be born into.

You can’t choose your gender, race, level of intelligence, physical attributes or where you will be born. It could be the United States or it could be Afghanistan. Your family might be rich or poor.

You could be healthy as an ox or have physical limitations.

What kind of society would you build?

Buffett says this ovarian lottery is “the most important event in which you’ll ever participate” because it will determine where you live, where you go to school, your financial circumstances, etc.

Some people win the lottery while others draw the short straw through no fault of their own.

He then shared some of the ways in which he won the ovarian lottery:

When (Charlie Munger and I) were born the odds were over 30-to-1 against being born in the United States. Just winning that portion of the lottery, enormous plus. We wouldn’t be worth a damn in Afghanistan. We’d be giving talks, nobody’d be listening.

Terrible. That’s the worst of all worlds. So we won it that way. We won it partially in the era in which we were born by being born male.

And we won it in another way by being wired in a certain way, which we had nothing to do with, that happens to enable us to be good at valuing businesses.

And you know, is that the greatest talent in the world? No. It just happens to be something that pays off like crazy in this system.

Buffett was born into the right situation, at the right time, in a system that just to happened to be perfectly suited to his strengths.

Timing isn’t the only thing but it matters a great deal in many aspects of life.

The Robber Barons of the Gilded Age were all born in the same decade — Andrew Carnegie (1835), Jay Gould (1836), John Pierpont Morgan (1837) and John Rockefeller (1839). When they came up in the business world, it coincided perfectly with the post-Civil War industrial boom.

The individuals who created the personal computer for the masses were all born in the same decade as well — Microsoft’s Bill Gates (1955) and Paul Allen (1953) along with Apple’s Steve Jobs (1955) and Steve Wozniak (1950).

If you started investing in the early 1980s, you came into a market at one of the most opportune times in history with extremely low stock market valuations and extremely high interest rates (that were about to go down).

Julian Robertson and Paul Tudor Jones both started their hedge funds in 1980.

Stanley Druckenmiller founded Duquesne Capital in 1981. Seth Klarman started Baupost Group in 1982. Jim Simons founded Renaissance Technologies in the same year. Mitt Romney’s Bain Capital started in 1984, followed by Steve Schwarzman’s Blackstone in 1985.

These are all supremely talented individuals who worked hard but also had fortuitous timing.

Luck and timing, both good and bad, are part of life.

My colleague Nick Maggiulli has this mind-blowing stock market stat he shares:

The best investors of the 1960s and 1970s would have underperformed some of the worst investors of the 1980s and 1990s simply because of the market environment.

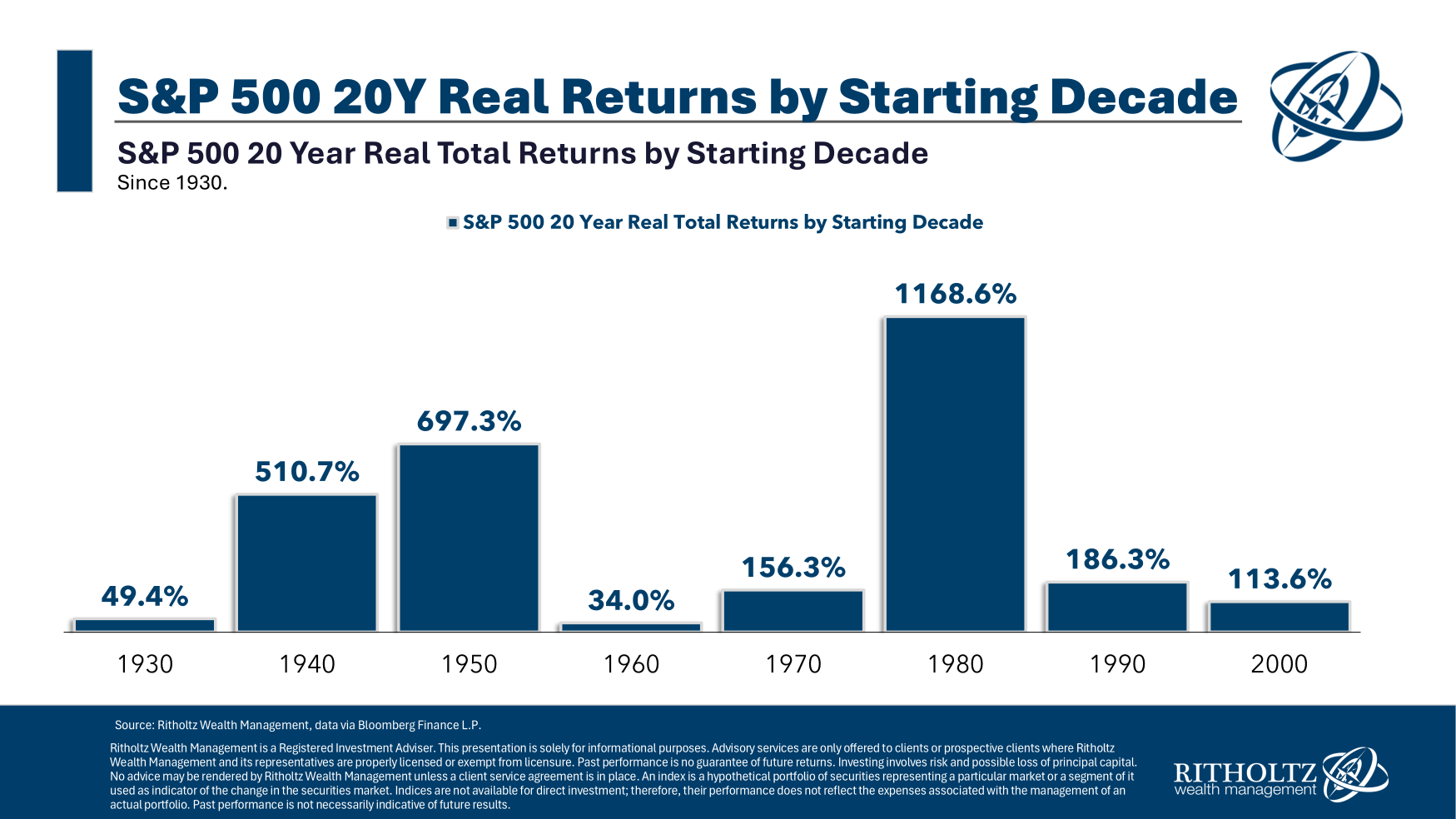

I looked at the 20 year inflation-adjusted total returns from the start of each decade going back to the 1930s:

No one controls when the market performs well or when it does poorly.1 It’s a roll of the dice.2

The same is true of the housing market.

If you bought a house before 2020 and refinanced at 3% during the pandemic you won the housing market lottery.

If you were forced to buy that same house today at prevailing prices and mortgage rates, your monthly payment would be 2-3x higher.

The young people who missed out on the housing bull market did nothing wrong. It was bad timing. The people who bought a home in the 2010s weren’t geniuses. They were lucky (me included).

Obviously, some people make their own luck, both good and bad.

Certain people would be successful regardless of their environment.

But it’s worth remembering some things are completely out of your control. You can control your effort and how hard you work. A lot of the other stuff is out of your hands.

You can’t teach talent and you can’t teach timing.

This is a lesson I try to teach my kids when it comes to sports. You are who you are when it comes to your genetics. Some people inherently have more physical gifts.

The two things I tell them are the most important when it comes to playing sports:

1.

Do your best.

2. Have fun.

Sometimes things work out perfectly for you.

Sometimes life isn’t fair.

That’s life.

Further Reading:

The Upside of Gratitude

1It’s worth noting that the luck involved in this part of the equation also has to do with where you are in your investing journey. If you started periodically saving during the periods of poor returns that’s actually a good thing going forward. The people who save for 20 years straight during the 1960s and 1970s were rewarded with higher returns in the 1980s and 1990s after years of building up their portfolio.

2The most recent 20 year period from 2005-2024 saw total real returns of +339%.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link