My colleague Nick Maggiulli posed a rhetorical personal finance question last week:

He’s right of course.

Big houses, luxury automobiles, nice boats, fancy clothes, expensive vacations, etc., these are status symbols.

Portfolio wealth is what you don’t see — the money saved, invested and not spent. I am in total agreement with Nick that we should celebrate the people who create wealth by not flaunting status.

We laud the billionaires and fake billionaires who pretend to be rich on social media by showing off their lavish lifestyles. Most people should look up to the Millionaire Next Door types who live below their means, save money on a regular basis and prefer a normal lifestyle with infrequent spending splurges on things they prioritize.

That’s my American (personal finance) Dream.

Nick’s thought gave me an idea though.

Let’s say you’re on a game show. I would say The Price Is Right, but kids nowadays would prefer Mr.

Beast. What if you won a prize and had to choose between a $3 million house and a $3 million portfolio?

Which one would you pick?

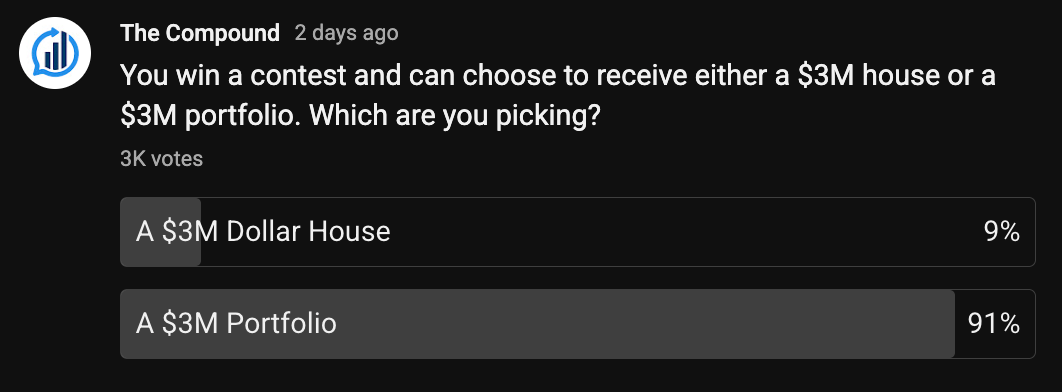

We polled our audience and the results were as you would expect:

The money offers you far more flexibility and liquidity. A house comes with property taxes, insurance, maintenance and upkeep. Money is the sensible choice.

I would take the house.

Surprising, right?

I’m a numbers guy.

That would be an irrational decision.

Here’s my explanation — at this stage of my life, a $3 million home would give me far more utility when it comes to experiences and happiness.

I know as a personal finance person I’m supposed to tell you the dopamine rush you would get from the house would wear off over time. I’ve read all the studies. But that hasn’t been my experience in practice.

Our lake house has made me happier over time. It’s more time spent with family.

More time outdoors. More time on the water. More experiences.

I don’t find any joy watching the value of my portfolio go up. Sure, it offers a sense of comfort and safety.

But the wealth goalposts don’t bring me more joy in my life.

Obviously, you don’t need an expensive house to create memories and experiences. I’ve simply learned that turning money into utility I can use over and over again, that brings me joy in life. Another number on a screen doesn’t do that.

Had you asked me 20 years ago, my answer would have been completely different. It might be different if you ask me in 20 years.

Your preferences can and will change based on your age, circumstances, and life experiences.

Sometimes they might even surprise you.

Michael and I talked about this financial exercise on this week’s Animal Spirits video:

[embed]https://www.youtube.com/watch?v=bdwAA-4JqZU[/embed]

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Best Investment I Ever Made

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services.

There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss.

For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Disclaimer: This story is auto-aggregated by a computer program and has not been created or edited by finopulse.

Publisher: Source link