Taxes

16 Business Finance and Tax Terms You Should Know

Running a business or a side hustle isn’t for the faint of heart. Whether you’re just starting out or you’ve...

How to Save for Retirement When You’re Self-Employed

Being your own boss comes with a variety of perks. But it also forces you to handle work typically taken...

Taxes on Social Security Benefits

November 18, 2022 Many taxpayers are often shocked to learn that their Social Security benefits can be taxed by the...

Don’t let Black Friday blind you to sales tax obligations

Holiday shopping season is here again – and eCommerce looks to be bigger than ever. But retailers looking forward to...

Top 5 Tips to Avoid an IRS Audit

November 16, 2022 The Senate recently approved nearly $80 billion in IRS funding, with $45.6 billion specifically for enforcement. This...

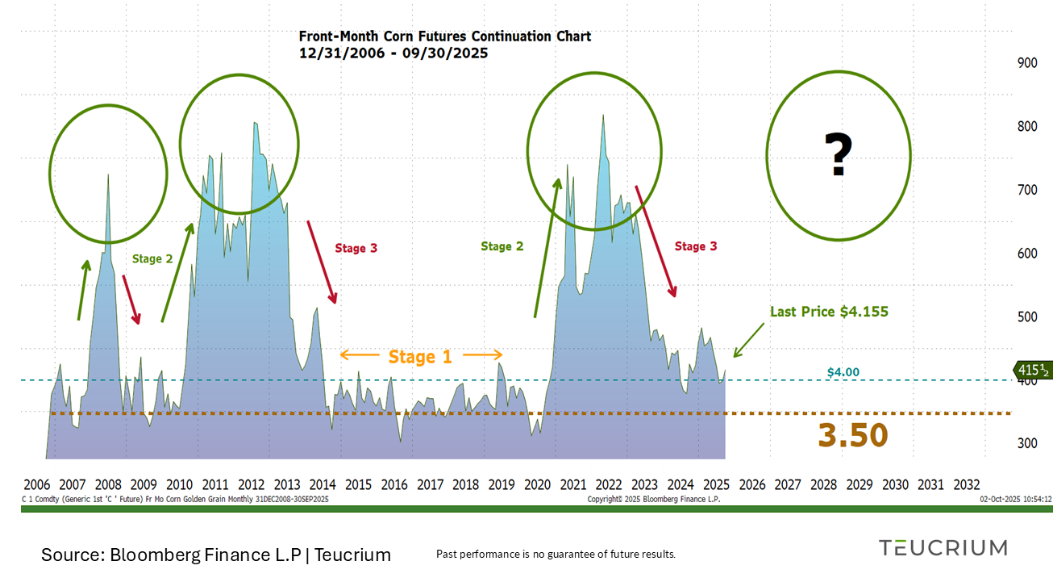

Should You Sell Your Investments Before the End of the Year?

With the holidays just around the corner and the end of 2022 approaching fast, you might be wondering: Should I...

Earned Income Tax Credit Calculator

Frequently asked questions Can I qualify with no children? Yes! This credit is now available to working adults aged 24...

Can I Be Claimed as a Dependent While Earning NIL Income?

College athletes scored a win in 2021 when the NCAA changed its policy, granting student-athletes the right to profit from...

Post-Grad Tax Guide for NIL Earners

Your tax return evolves with your career and financial situation — so what does tax filing look like for student-athletes...

TaxConnex™ Proud to Exhibit at Thomson Reuters SYNERGY 2022 Conference

Alpharetta, GA., November 11, 2022 - TaxConnex™, a technology-enabled sales tax compliance outsourcing provider, shared that they are exhibiting at...

Gambling Income and Losses

November 10, 2022 When we think of gambling, our first thoughts may be of casino games or the lottery. However,...

Top 7 Reasons to Switch to TaxAct

Thinking of switching online tax prep providers this year? Look no further. E-filing with TaxAct® gives you the tools and...