A reader asks:

What’s the story with gold these days? My understanding is that in times of peril gold is where people go. In the most perilous times in the last ~5 years I feel like the price of gold really didn’t do anything. It wasn’t the hedge that most people associate with it. Can you thread the story of the stock market, interest rates, and gold. Is gold no longer a good hedge against market turbulence? Make it make sense.

Markets don’t always make sense.

That’s part of what makes them so interesting. Investing would be easy if it could be solved with simple if/then formulas. Unfortuately, it doesn’t work like that. Markets are constantly evolving, investors are constantly learning and no two environments are ever the same.

Things that have never happened before happen all the time.

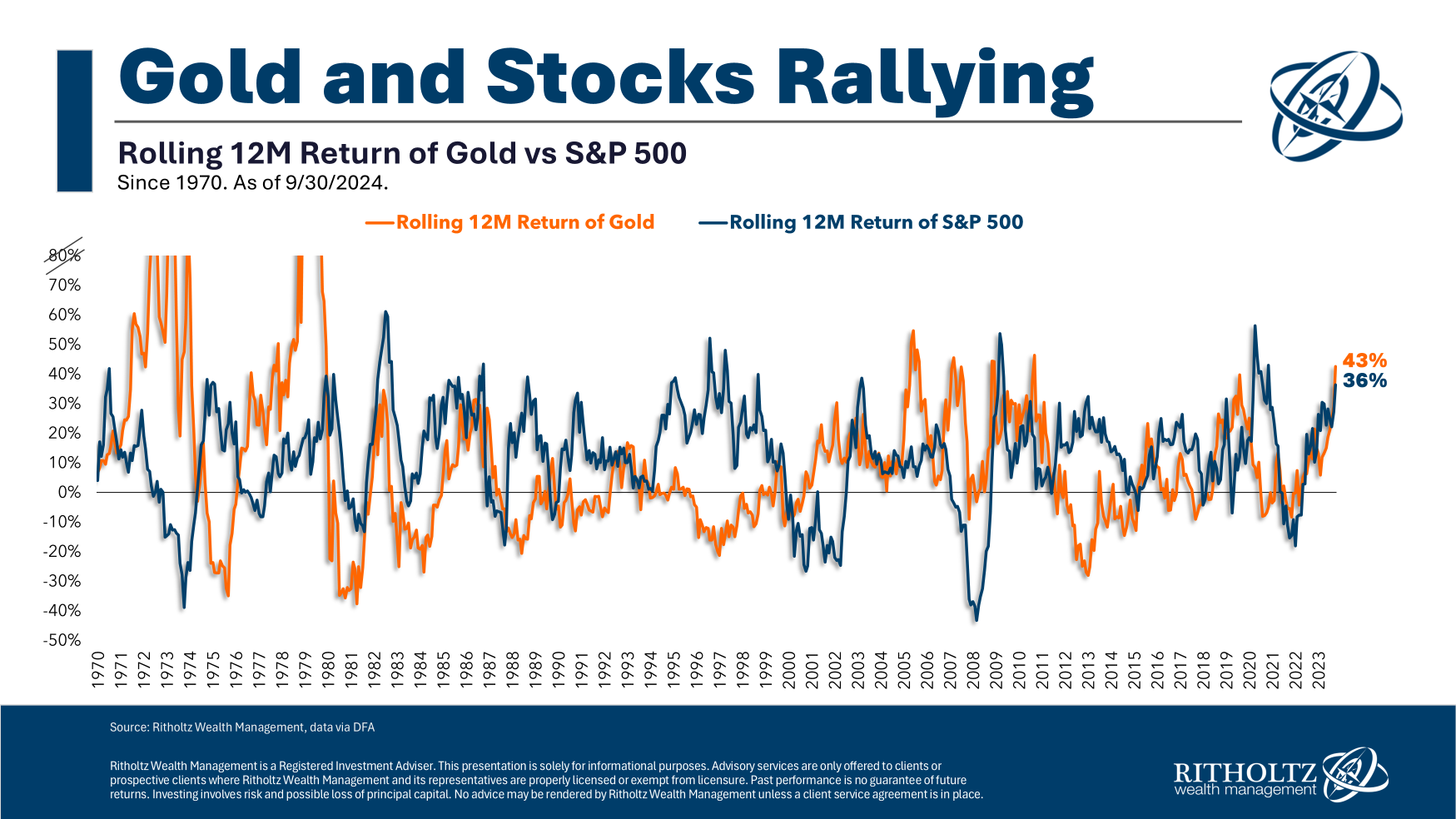

For instance, look at the trailing one year returns for gold and the S&P 500:

They’re both up around 40% over the past 12 months. This almost doesn’t seem possible.

Take a look at the history of rolling 12 month returns1 for both gold and stocks going back to 1970:

These two assets rarely trade in lockstep, which is one reason so many investors like gold as a diversified asset.

I could find just one instance over this 55-year window when both stocks and gold were up as much as they are today simultaneously–when gold was up 49% and the S&P 500 was up 39% in the 12 months ending November 1980.

It is important to note that gold is not necessarily negatively correlated with the stock market. In fact, there is basically no correlation over the long haul. The correlation of monthly returns is essentially zero, meaning one set of returns doesn’t really impact the other and vice versa.

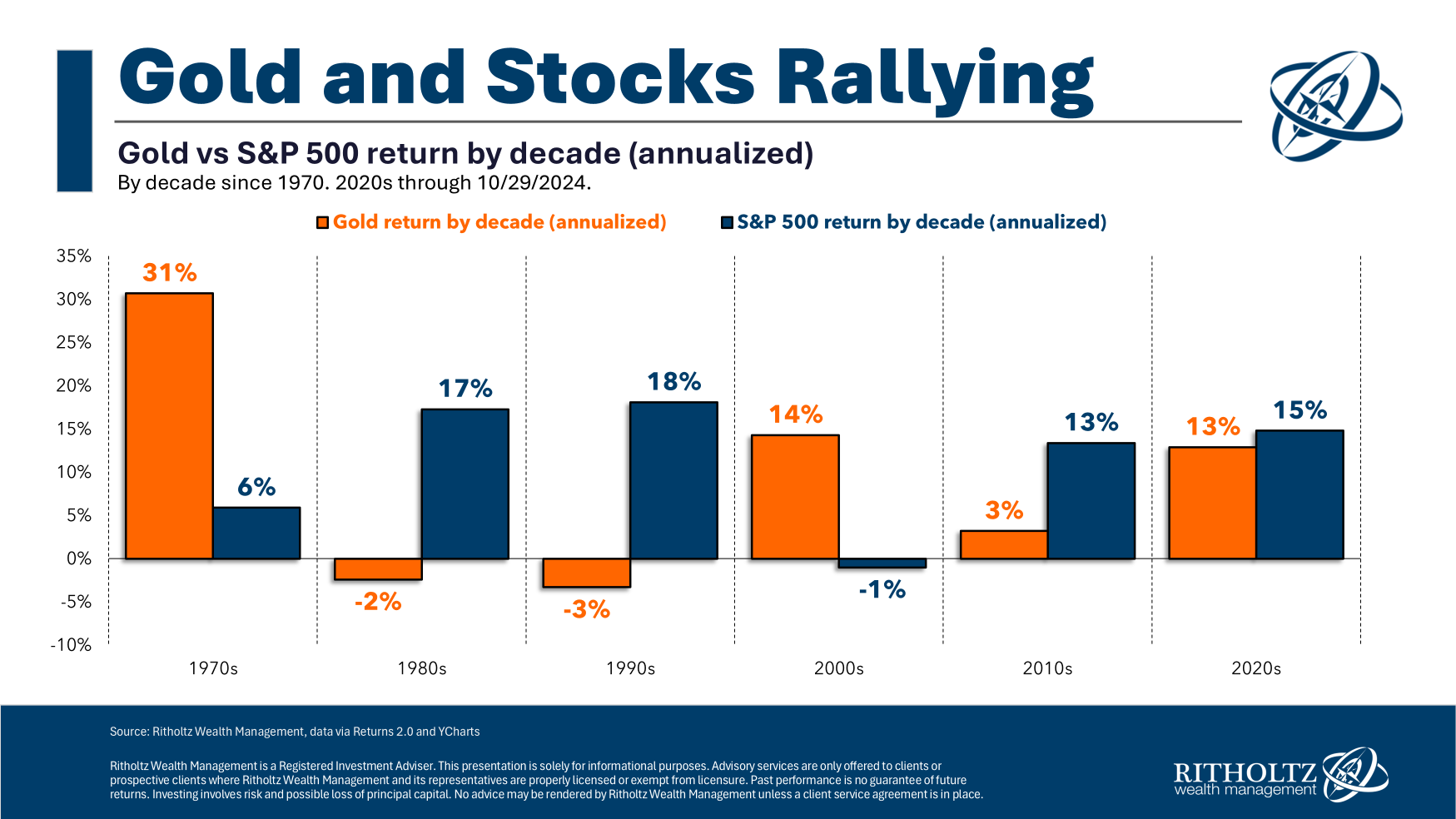

Now look at annual returns by decade:

When stocks struggled in the 1970s, gold was lights out. Gold went through two lost decades when the stock market knocked it out of the park in the 1980s and 1990s. Gold woke up in the 2000s when the stock market had its own lost decade. The 2010s flipped the other way.

Stock market returns can be lumpy. Gold returns are extremely lumpy.

But now we have a situation where both gold and stocks have had strong returns this decade. I’m not sure that was on anyone’s bingo card (do people still play bingo?).

It’s also strange to see gold rising at the same time interest rates have been moving higher. There is this idea that gold performs well when real rates are falling because gold doesn’t provide any cash flows or income. That makes sense in theory but real rates have been moving higher with gold for most of this year.

Some people assume gold is an inflation hedge but when inflation screamed higher in 2022 gold was essentially flat. Inflation has been falling all year in 2024 yet gold keeps going up.

Some people point to government spending and deficits as the reason for gold and the stock market both doing well but that feels like a rearview mirror take.

‘What’s the reason?’ is probably not the right question. Does the reason even matter?

Investors love form-fitting narratives to market moves because it makes you feel more certain in an uncertain world. But the narratives always come after the fact. No one ever writes the narrative before the move happens. Price drives narrative.

And flows drive price. If you really want to know the reason gold is going nuts this year it’s because large institutions are buying gold hand over fist.

Nick Colas made the case to Josh earlier this week on The Compound that the reason gold is rising is because central banks around the globe have increased their gold purchases:

That makes more sense to me than some macro narrative. Obviously, macro narratives can also influence flows so there is some circular logic here.

My point is that non-correlated assets aren’t always going to make sense because markets don’t always make sense and the actions of investors can trump rules of thumb.

If you’re a diversified investor you have to get comfortable with asset classes and strategies that always act like you think they should.

Jill Schlesinger joined me on Ask the Compound this week to answer this question:

We also discussed questions about Roth vs. traditional retirement accounts, the pros and cons of targetdate funds, retiring in your mid-30s and what to do about big gains in Mag 7 stocks.

Further Reading:

What’s the Investment Case For Gold?

1I had our chart guy Matt cut off the tops of the gold chart here because some of the returns in the 1970s were so high. The best rolling 12 month return for gold was nearly 180%. For stocks in this period it was 61%.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.

Publisher: Source link